My teammate, Noah Gross, and I grew up working in restaurants. Some of our first jobs as kids were hosting, waiting tables, running registers, doing inventory, and prepping for the next shift. Really, whatever it took to get food into the hands of our hungry customers. The work was hard and, at times, grueling. There is a certain grind involved in restaurant work that is different from other businesses, and this may always be the case.

With that said, the restaurant industry (and food supply chain, more broadly), still relies on countless manual inputs. The industry as a whole has lagged behind other verticals where the uptake of technology has been more pronounced. There are many drivers of this behavior, but as more vertical-specific technologies are beginning to surface, the restaurant industry is starting to become even more digitized and even more automated.

In a recent conversation, my teammate, Alex, put an interesting spin on how this shift seems to be taking place. It feels like we are in the midst of what is the third wave of tech transformation (wave 3.0) within the industry.

- The first wave (1.0) was simply establishing a digital presence (building a website; publishing your menu online, maybe even allowing customers to book a reservation).

- The second wave (2.0) was characterized by a rush of online information aggregators (e.g. Opentable, Tripadvisor, Yelp, Google, etc.) that created distribution for many restaurants for which it would have otherwise been too burdensome or expensive to generate independently.

- And then there was part two of this second wave (call it 2.5), out of which spawned online delivery platforms such as Doordash, Uber Eats, and Deliveroo, which instead of acting as an information exchange, literally provided a new conduit for the food itself.

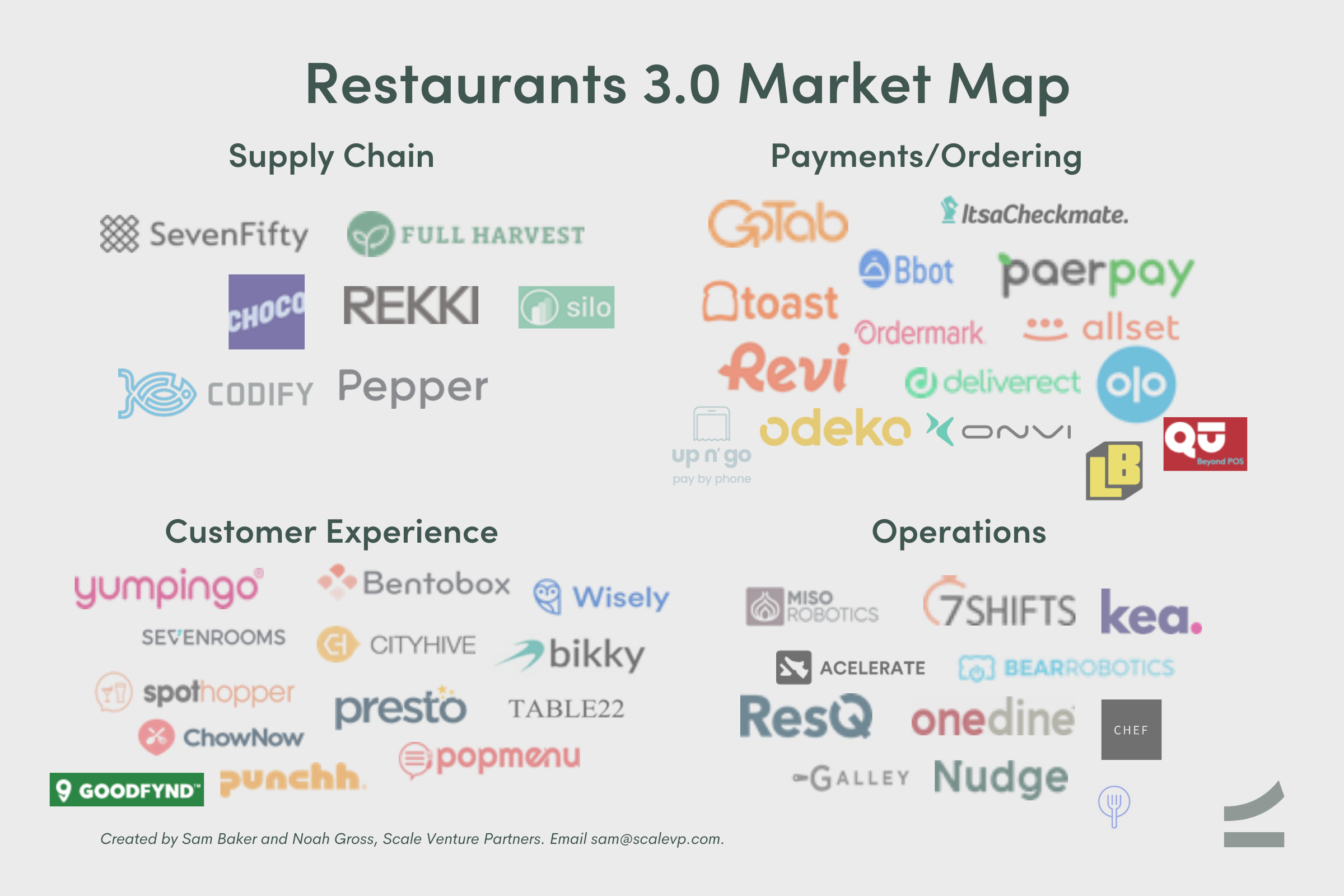

What we have recently observed in the market is a third shift that is engendered by a new wave of digital solutions that are returning control of the customer lifecycle (and all of the data and workflows that come with it) back to the restaurant owner (vs. a third party). We have been keeping a close eye on the shift that’s happening and, in the process, have spoken with dozens of emerging companies and restaurant operators to better understand some of the nuances in the market. We thought we’d share a few of our observations below:

Setting The Table

Everyone needs to eat, but few understand the many underlying complexities and challenges that exist within the ecosystem. According to the National Restaurant Association, there are more than 1M restaurant locations in the U.S. that, before the pandemic, collectively represented more than $1T in annual revenue. The industry is simply massive, but it is also characterized by an unusually long tail of small businesses, with 9 of 10 restaurants employing fewer than 50 staff members.

As such, most restaurants do not have the luxury of implementing complex systems and automated processes that often come with scale. Profit margins within the industry are notoriously low (if you are a restaurant pulling in low double digit net income margins, you are probably quite happy). This setup historically hasn’t lent itself for much reinvestment in the business, let alone adoption of new technology.

Even at greater scale where one is likely to encounter more systems and automation, replacement cycles can be long and disruptive – which is one of the reasons, for example, you still may encounter point of sale systems, e.g. Micros (now owned by Oracle) or Aloha (owned by NCR), which initially came to market decades ago. The industry is known for unusually high employee turnover, and in recent quarters, rising food costs. These factors, among others, contribute to one of the unfortunate complexities within the industry: a very high casualty rate. Around 60% of restaurants fail within their first year; 80% fail within their first five.

A Year of Transition

The COVID-19 pandemic in one sense had a catastrophic effect on the restaurant industry. At the end of 2020, the industry ended the year with total sales of $240 billion (27%) short of pre-pandemic forecasts. As of December, 2020, more than 110,000 (more than 10% of all US restaurants) were either temporarily or permanently closed.

But in the wake of such challenges, opportunity emerged. The COVID-19 pandemic had a pronounced effect on almost every business within the space, but it also forced a reconstruction of the industry, whereby many owners began to view the adoption of new technology, not just as a business enhancement, but as a necessity. Innovation was no longer an existential crisis, but, for many, a life or death decision. The National Restaurant Association estimates that more than 40% of all restaurant operators adopted new technology during the pandemic to accommodate online orders, as well as contactless and digital payments. Toast, a rapidly growing point of sale solution for small and medium sized restaurant concepts, recently published that in 2020 82% of Toast customers placed their orders online or via mobile app (vs. 51% in 2019 before the pandemic struck). Even if online orders don’t stay at this high water mark, our suspicion is that there will not be a pronounced retreat. Both consumers and restaurant owners have grown comfortable with (and in some cases, greatly benefitted from) the dynamics of online ordering, and this is just one example of a new wave of digitization that is helping return data back to restaurant operators.

The Next Course: What Will The Future of Restaurants Look Like?

The wave of new tech that is passing through the restaurant ecosystem will bring with it the added benefits of process automation and systems cohesion. As we think about what restaurants of the not-so-distant future will look like, we offer below a set of predictions that we believe will take shape.

Restaurants will universally become more digital, data-driven, and defined by automation. The digital properties of restaurants will become the center of gravity of the business. As many restaurants continue to experience some of their highest volume of online orders, operators will shift towards specialized hosting platforms that can accommodate workflows that are different from those in other verticals (e.g. frequent menu changes, specials, loyalty programs, gift cards, and back of the house connectivity). Companies like Popmenu, Lunchbox, and Bentobox are helping operators push beyond the basics of specialized web design and regain control of the customer journey in ways that were previously untenable.

Operators will demand the ability to own their own customer data and manage their entire guest lifecycle. Many of the widely popular information marketplaces (i.e. Google, Yelp, OpenTable, TripAdvisor) enabled restaurants to gain mass distribution into new customer segments. But the tradeoff here was that they retained control of all of the customer data (page views, reviews, reservations, etc.) that users generated. A new wave of solutions, such as SevenRooms, is attempting to reverse this trend by returning the data flow back to the restaurant and providing more visibility into the entire customer journey (and, therefore, enabling more customized experiences).

Restaurants will take advantage of the API economy that is enabling the connectivity of disparate systems that until recently were unable to communicate with one another. In the same way that Twilio forever changed the world of communications and Stripe did for payments, restaurant owners will be able to take advantage of connectivity that is weaving together workflows both in the front and back of the house, inside and outside the restaurant. Businesses in the likes of Bbot, OneDine, and GoTab are ushering in innovative ways of connecting online and / or in venue ordering modalities with other internal systems and workflows.

Restaurants will have a greater reliance on online marketplaces to drive distribution, not just at the end of, but throughout their entire supply chain. Online marketplaces will extend to much earlier segments of the restaurant / food supply chain. Silo, for example, is transforming the way that farmers and growers match with wholesalers and distributors at the earliest segment of the food supply chain. At a later stage in the food supply chain, Rekki and Choco, for example, are abstracting away the painful process that chefs endure to order and reorder ingredients. And of course, online delivery marketplaces such as Doordash and Deliveroo have forever changed consumer behavior by bringing together restaurants and hungry tummies at the very last mile of the supply chain.

Restaurants will continue to leverage intelligent systems (including bots and robotics) to assist with order management, reservations, preparation, delivery, and eventually, other customer interactions. Today, we wouldn’t count on your next Michelin star rated meal to be prepared by a robot, but the next time you call to make a reservation or place a takeout order, don’t be surprised if the person who answers isn’t a human. Restaurants of the future will begin to augment the human workforce with automated solutions across various modalities. Kea.ai, for example, has developed an automated bot that uses natural language processing to assist in taking orders over the phone, and Bear Robotics, has built autonomous mobile robots that assist with delivering food and drinks in many well-known quick serve restaurants. We suspect that it won’t be long before robotics find their way into other workflows such as prep, delivery, and clean up.

Our Takeaway

We continue to be compelled by the current digital transformation that is happening across the restaurant ecosystem. This shift is similar to that which we’ve observed in other verticals, whereby operators can drive better process automation and systems cohesion through the adoption of new technology.

To be clear, tech will not be a solution for every industry challenge. There is an inextricable, human component within the food services category that, in some ways, may still be the most integral part of the customer journey — and that should not be left unsaid.

There will, however, be many gaps that technology can bridge, and if you’re an entrepreneur working on an interesting problem that makes things easier for restaurant operators, we’d love to talk to you.

My teammate Noah Gross was instrumental in helping conduct the market research and analysis that went into this post.