In a recent video series, my partner Rory O’Driscoll mentions “The act of innovation, the act of startup is what sets up the opportunity for greatness. The scaling stage is what allows you to grab that greatness and build a lasting company.” Often in order to build lasting company, you need to grow quickly to beat the competition and grab market leadership. That being said, you also need to be aware of market conditions and growing efficiently so you don’t burn out. Where is the right balance between quick growth and efficient growth?

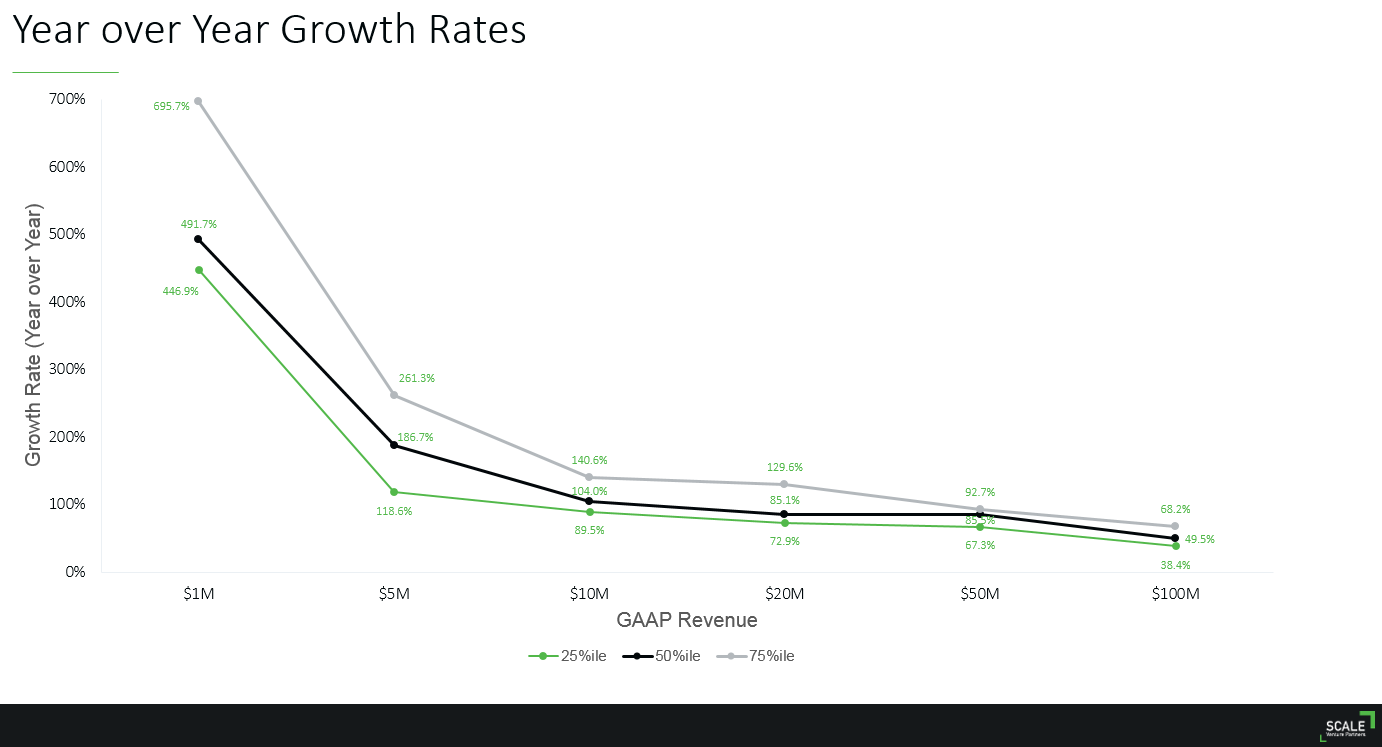

Scale’s Growth Rate Benchmark looks the growth rates for private SaaS companies based on revenue size. We have profiled over 30 private companies and their historical financials to come up with a benchmark of how fast companies grow year-over-year at each stage in their lifecycle.

At the risk of stating the obvious, growth tends to slow down as companies get bigger as the market becomes more saturated, the competitive landscape changes and customer needs evolve. In fact, Andy Vitus points out that the predictable growth persistence is 85% of your growth rate the year before.

However, there is a class of companies that buck this trend and bend the growth curve as they reach to grab greatness. Those are the companies that end up on the 75% line (or better) and accelerate their journey to IPO. And the difference in value created is vast depending on which growth curve you follow. Furthermore, we believe as a new enterprise software market starts to emerge, you frequently have two to four viable contenders, all slugging it out to be the market leader. Couple this with the SaaS business model, where the sales and marketing investment model is very capital intensive upfront and it takes the combination aggressive growth, subject to a profitable unit sales model, to get to the number one position.

For smaller companies, the gravitational drag on growth rates means that high triple digit growth rates won’t always be the norm. Soon, your growth will return to Earth and you’ll need to figure out ways to keep your growth rate aloft. What this means is that you’ll come off of your early successes of landing your first few customers and need to demonstrate that the go-to-market model you’ve developed is truly scalable and repeatable. It also means that in order to keep a high growth rate, you’ll need to accurately identify when your existing go-to-market model needs to be augmented or adjusted and what the right changes are that let you accelerate your growth trajectory.

For larger companies, your story of growth may look like something on this continuum.

$1M -> $5M -> $20M -> $50M -> $100M

With more time, you’ll bring in more than $100M in annual revenue and hopefully still be growing at >60% per year. That requires changes to your go-to-market model, new product and buyers to keep growth rate accelerated.

In this blog series on scaling, we’ll talk with a few of our entrepreneurs and identify how they were able to accelerate growth on their journey to greatness. We’ll talk about how to run experiments to find the go-to-market model that works best for you and how to scale that efficient model into hyper growth. We’ll also dive into slowing growth and how you’ll need to find out ways to bend the curve to accelerate your growth trajectory.