As we head into the final weeks of 2021, companies everywhere are finalizing their 2022 plans and growth targets. We wanted to recap some of the trends that emerged during 2021 and set the backdrop for performance and plan success in 2022.

First Quarter Showed Growth Momentum Was Real

Despite how 2020 began, many companies ended 2020 with a lot of optimism about 2021 as seen in annual plans with aggressive growth expectations. But was there another shoe to drop? By April, it was clear that the optimism was justified and that the growth re-acceleration was real. The year’s first quarterly Scale Studio Flash Report showed enterprise SaaS on a trajectory that put those lofty goals well within reach.

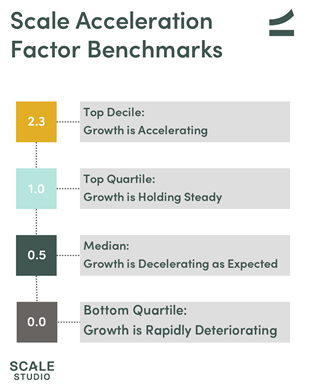

The most telling (and encouraging) data point from that report was the newly introduced Scale Acceleration Factor metric, which we conceived as a quick way to predict the direction of future ARR growth rates.

The 1Q Flash Report showed that the median acceleration factor was 1.4x, indicating that growth was holding steady or accelerating, with a big spread across performance tiers:

- 90th percentile: 8.55

- 75th percentile: 4.47

- 50th percentile: 1.39

- 25th percentile: 0.10

By the end of 1Q, it was clear enterprise software startups were only getting started.

Second Quarter Was the First Year-on-Year COVID Comparison

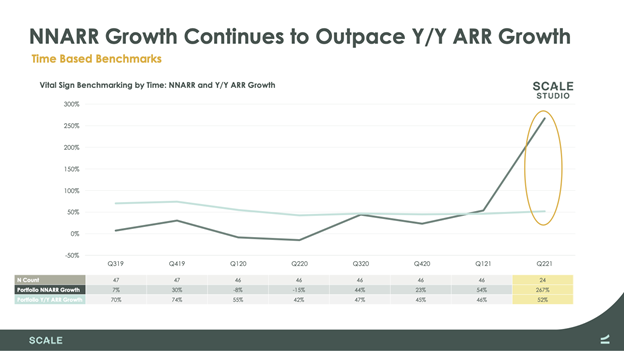

Q2 marked another quarter of strong performance where the majority of our sampled companies met or exceeded growth targets. As the first year-over-year comparison of business conditions in 2021 versus the onset of COVID in 2Q20, data clearly showed growth headwinds winding down or outright gone.

We saw dramatic growth with top-decile performance remaining consistently explosive: the top 10% of startups were posting >6x NNARR growth. Coming off of 1Q strength, the trend of strong NNARR growth was solidifying as seen here:

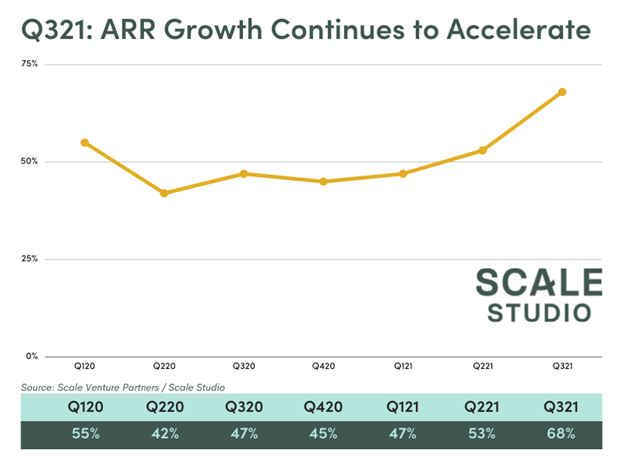

Third Quarter Tests the “Great Reset”

Would momentum continue? We described 3Q21 as the first real test of the “reset” that took place during early COVID, when companies dropped all but their core “must have” software. SaaS aced that test, with ARR growth rates leaping past even pre-COVID highs.

We also saw a return to a typical mix of companies re-accelerating versus those that were decelerating: 32% of companies posted NNARR Growth Rates higher than their Ending ARR Growth rates. This is in line with historical norms where about one third of companies will accelerate their growth rate in any given period.

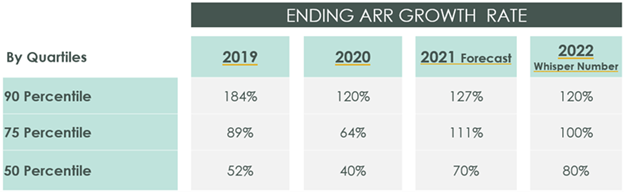

Startups CEOs Optimistic for Continued Growth in 2022

In November, we surveyed startup CEOs and CFOs on their expectations for 2022. This year’s 2022 whisper numbers point to expectations for a healthy environment for enterprise software next year. Though it’s noteworthy that the projections don’t quite match the same degree of optimism that we saw last year (see 2021 whisper numbers for the numbers).

2022 in a nutshell shows startups expecting strong growth to continue. We added an “asterisk” to these expectations, because there are two currents forming around two important expense categories:

- Real estate. Physical real estate usage is in flux with a lot of change on the horizon during 2022. Companies are still figuring out the post-COVID office, with a lot of office space likely to come back online during the year. Some companies may end up seeing cost savings (and thus upside) from real estate but the uncertainty makes it hard to plan for.

- Employment costs. This is the big one. With the “Great Resignation” underway and inflation in the headlines, it’s safe to say that both hiring costs and salaries are going higher in 2022. Again, this will look different at different companies, but we’re seeing companies assume compensation expenses will go meaningfully higher in 2022 relative to 2021.

What surprises will 2022 bring? In our next Scale Studio Flash Report for 4Q21, due out early next year, we’ll continue monitoring the factors driving the enterprise software market and individual company performance within it. Until then, best wishes and happy holidays.