The Box team has always done things early, and in 2020 Box went through a transition that most SaaS companies are about to go through in 2023. After more than a decade of explosive growth, with cheap capital to finance that growth, Box faced a slowing business environment with increased competition. Revenue growth declined from 27% in 2017 to 11% in 2020. At the same time there was increasing pressure from shareholders, including activists, to get profitable quickly. The challenge for Box was not just about getting to profitability. The real challenge was continuing to invest in building a compelling enterprise-grade product while at the same time making progress towards best-in-class profitability. How Box handled that pressure can be a model for what most CEOs and CFOs are dealing with in 2023.

In late 2022, I talked to Dylan Smith, Box’s CFO since its founding in 2005. In the webinar, we focused on the practical steps Box took on the cost side to get from an operating loss of 11% of revenue in 2017 to an estimated operating profit of 23% of revenue in 2022 and profitable on a GAAP basis. We talked about what they chose to cut and what they chose to keep and how they made those decisions. We discussed what worked and what didn’t. Hopefully some ideas will help teams wrestling with the same dynamics in 2023.

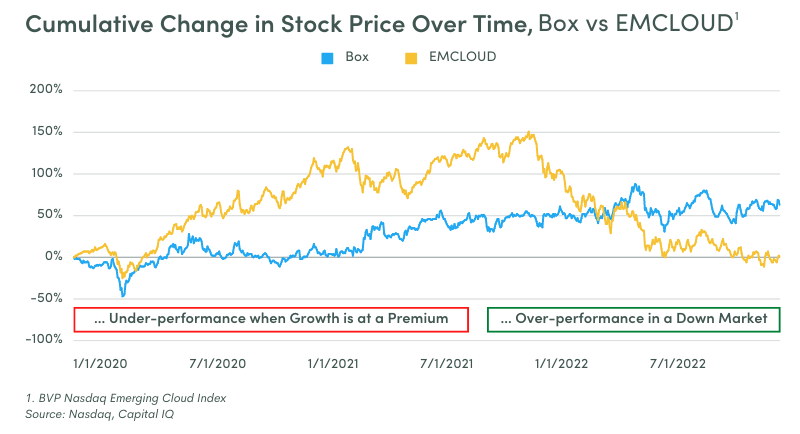

For Box the good news is it worked. The chart above shows the stock price from Jan 1st 2020 to today. The company underperformed the market in 2020, as it had to focus on profitability while many companies were benefiting from COVID revenue tailwinds. However, as the markets pivoted to valuing profitability, or more accurately, since the market started hating losses, Box stock has outperformed its peers.

The rest of this post is some context from my perspective as a board member of Box from 2010 through to 2020,what I learned from that journey, and how it has influenced my thinking on other deals in 2023. I am long off the board and don’t speak for management but this is what I took from that experience. On Monday we will see what Dylan thinks!

Box’s Journey: 2010 to Present

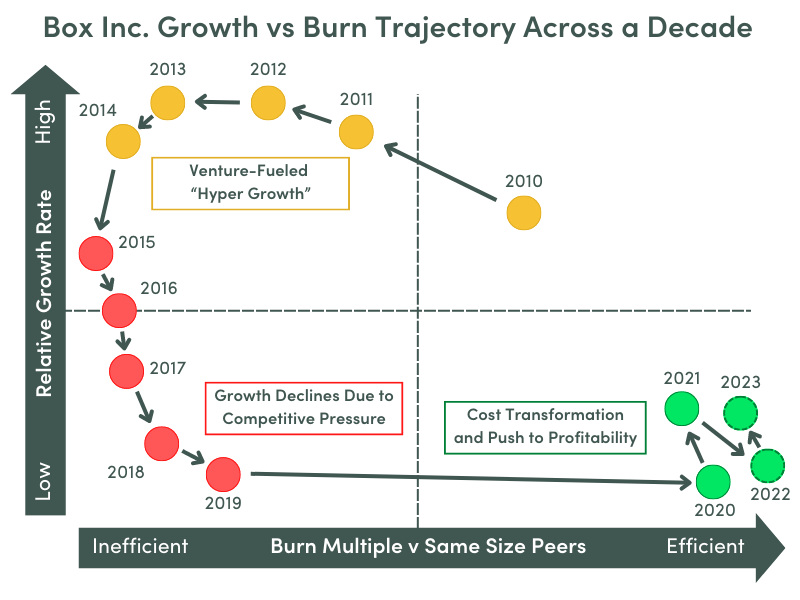

Box went all in for growth in the period starting 2010. There were a slew of competitors in the enterprise file sharing market and the risk of Microsoft getting there was ever present. The only way to win was to get big fast and we did. From 2010 and to 2016 the CAGR was 87% and the company grew from $5M run rate to over $400M. Growth rate went up, efficiency went down but we established the enterprise management category, got public and became the winner in that category. Most of our early competitors failed or were acquired for small dollar sums.

Over time growth rates began to decline, not just in absolute terms, but relative to other similarly sized companies. With increased competition it was getting harder for Box to generate growth and that growth was costing more. At some point that model doesn’t work and the period from about 2018 to 2019 was the hardest. The company still wanted to be a high-growth company but the return on investment just was not there. Box was stuck in “no man’s land” with the expense profile of a high-growth company but that growth was on the come. Basically we were in the middle of a strategic transition but our financial profile had to change for us to survive through that transition.

In the 2020 to 2022 time period that is what the Company did. Box was barely break even in 2019 and today the company is tracking to an operating profit of 23% of revenue for 2022. Growth dipped to a low of 8% in 2020 and is currently running at about 17% a year (constant currency) at a revenue run rate of $1Bn. This financial performance was only possible because of the continued evolution of the product, and the investment in building the features enterprises value most. Most impressively, Box is still an independent founder-run public company that has outperformed the market since the SaaS crash, is profitable and has control of its own destiny. That is a fate a lot of SaaS founders would like to share in 2023.

This simple chart shows the entire journey. It shows growth rate (relative to similar sized peers) on the y axis and burn multiple (or eventually profitability) also relative to similar sized peers on the x axis (check our tool here to plot your own path). The entire journey is clear, from explosive growth, to de-acceleration to profitable and re-accelerating growth (using analyst estimates for 2023). I will say it again, this is what winning looks like in SaaS in 2023.

Lessons Learned

Some lessons that I learned as a board member from this journey are:

- When the facts change, you gotta change. As a board member who had been part of the hyper-growth part of the journey I was slow to realize those days were over. There was a temptation to give it one last try to see if growth could come back but it didn’t, and that consumed resources that we could have used later.

- New voices around the table can help. We recruited some amazing new board members who came unencumbered by the past and forced us to address cost issues that were long in the making. From the outside we had lots of forceful comments from activist shareholders. I didn’t always agree with their solutions but they were right to call attention to the problem.

- Driven adaptive management teams, especially founder-led teams, are a company’s superpower. The ability of the founding team at Box, led by Aaron and Dylan, to adapt and play a different game is what made the difference. It is very hard to go from a growth at all costs mindset to pinching the pennies. It sucks to be unwinding investments you made only a year ago but they did it. At the same time, they held fast to what matters and continued to invest for the upside. The founding team believed in the opportunity for a standalone enterprise content management company that could compete and win against the largest software company in the world. The evidence today says they are right. To be that company, Box continued to invest in R&D and Customer Success throughout the entire period to build a differentiated product. They cut Sales and Marketing spend in absolute terms while broadly holding R&D flat but making it far more efficient.

The results speak for themselves. When I hit save on this blog post it will save to Box. It will not save to some bland embedded product in a Big Tech product suite mish-mash. For that, I will smile and think fond thoughts of the whole Box team.

I believe the Box experience in 2020 will be the universal SaaS experience in 2023. Growth is going to slow across the board and every company will have to dust out the “get profitable while preserving the upside” playbook. Hopefully these learnings from Box can help.

All views above are my own and not representative of Box, Inc.