Scale collects quarterly data and annual projections from our portfolio companies then shares portfolio-wide data back to them with commentary each quarter. The goal is to provide our portfolio (and, via our blog, the enterprise SaaS community) hard facts to use in their financial planning. For reference, see the Scale Studio Flash Reports from 1Q, 2Q, 3Q, and commentary on annual planning for 2021. We now have initial FY21 plans from a significant cross-section of the portfolio. This blog post gives an overview of what we are seeing.

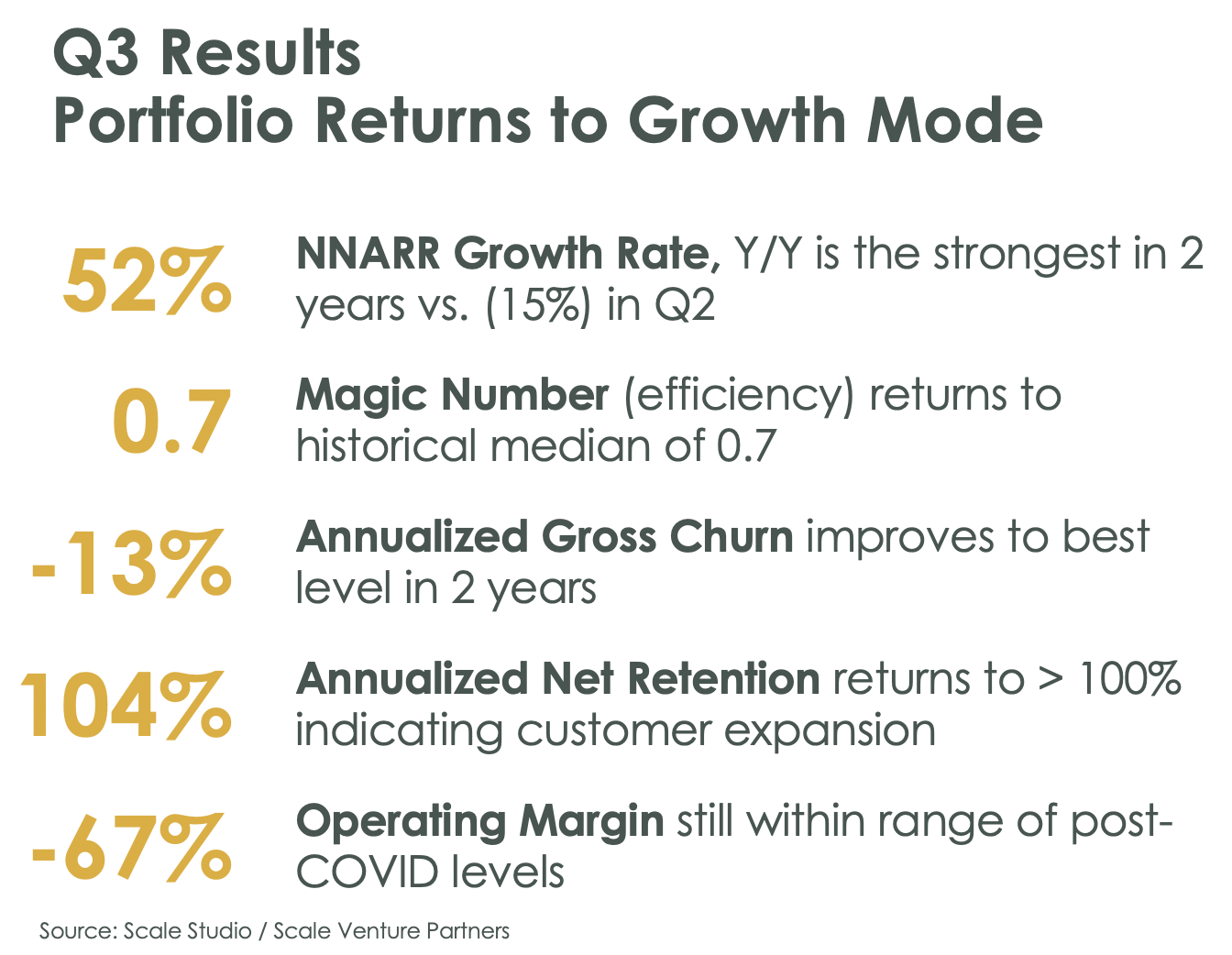

Setting the Stage: Strong Q3 Results

Quick recap: Q3 was a strong quarter after an extremely difficult first half. The key metrics are shown below. Most were at or above pre-COVID levels, including Growth Rate, Sales Efficiency, Churn, and Operating Burn.

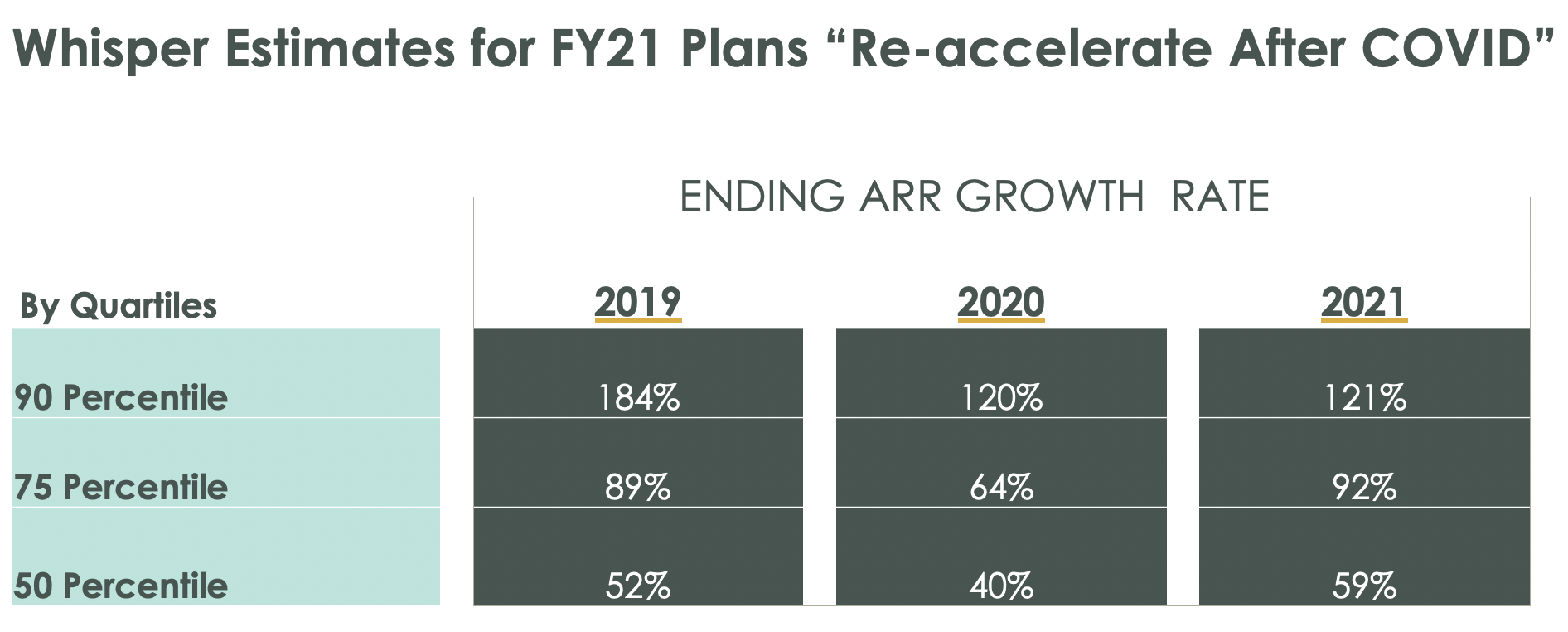

Optimistic Plans for FY21

Across the board, companies are planning significant re-acceleration in 2021. At the 90th percentile (ranked by 2020 ARR growth), these companies were unaffected or even positively impacted by COVID and are forecasting more of the same in 2021. At both the 50th and 75th percentiles, companies are forecasting growth, as measured by Exit ARR run rate, to improve significantly in 2021 versus 2020.

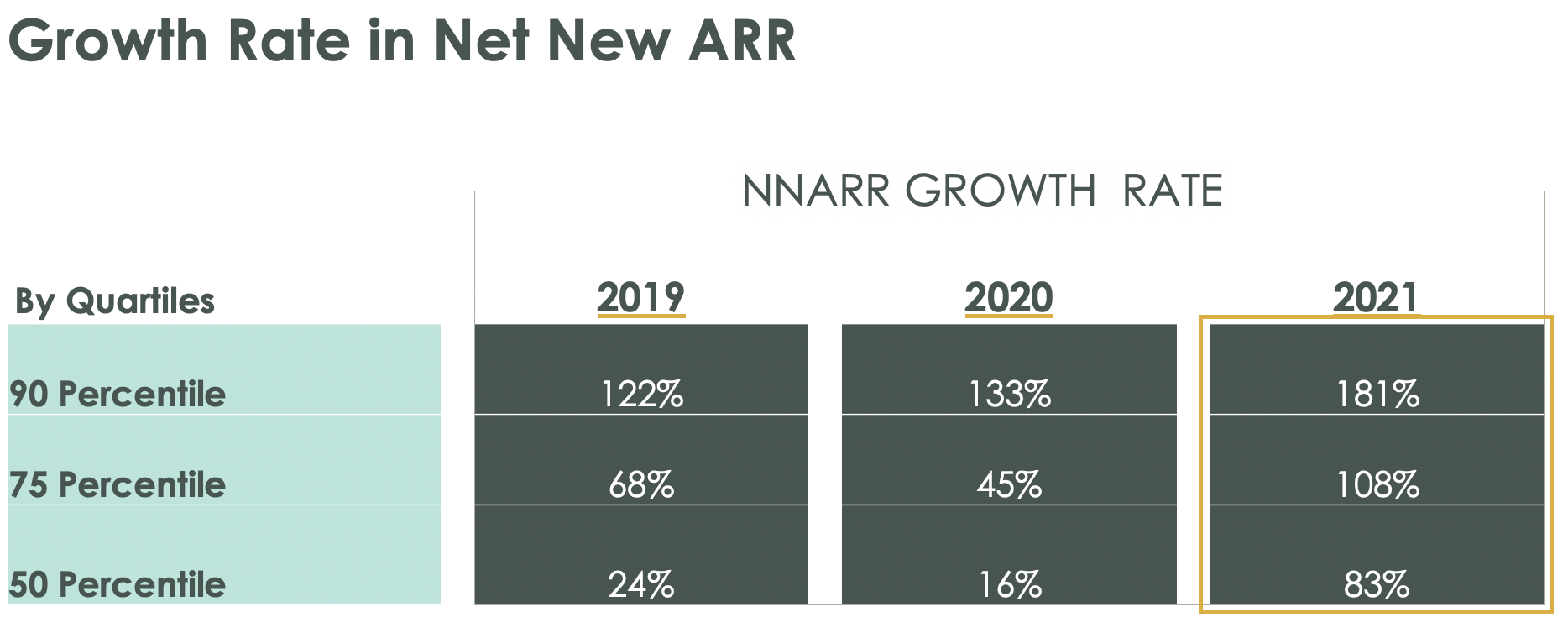

Net New ARR Growth Rates Show How Much Improvement Is Required

Exit ARR growth rates can mask what is required to change a trajectory after a tough year. Take for example that 50th percentile category. Changing the Exit ARR growth rate from 40% back to 59% does not sound too daunting. However, when you look at the change required in terms of Net New ARR it becomes clear what a “lift” it will be to make that happen. Net New ARR which grew only 16% in 2020 has to increase by more than 5x to 83% to achieve the Exit ARR growth as planned. This metric better captures all the changes in new sales, upsells, and churn required but without the smoothing effect of total ARR.

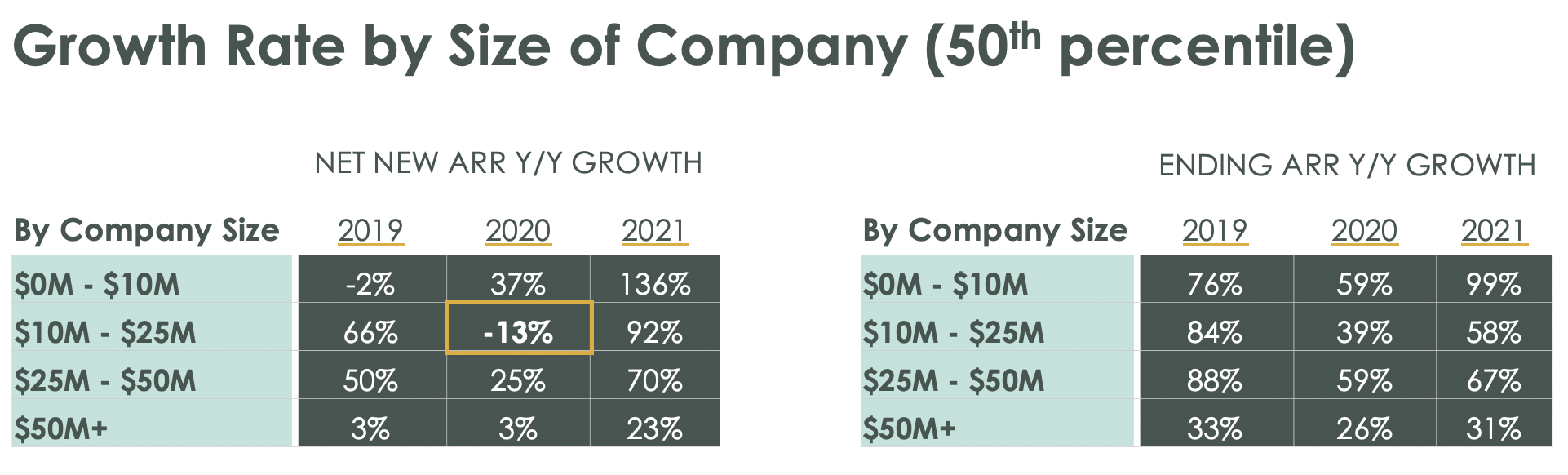

COVID Most Impacted the “Teenagers”

A “good” growth rate differs by size of company. At $100M in ARR, a growth rate above 30% is a fine result. At $1M in ARR, it presages irrelevance.

The chart below shows the 50th percentile growth rate for our portfolio companies bucketed by ARR. The pattern of broadly declining ARR growth with size holds roughly true, though with a smaller number of companies there is some noise in the data.

One result that shows clearly is that the “teenagers”, companies with $10M to $25M in ARR, were hardest hit by COVID. Smaller companies with less than $10M were impacted, but because burns were not as high in absolute terms, the pullback in capacity was less dramatic. Much larger companies had an installed base to fall back on.

The companies in the middle were trying to grow aggressively and had invested significantly in sales capacity. As COVID hit, Boards pushed back on burn rates, which meant cutting capacity, which in turn means lower ARR growth. These are the companies that are trying to re-accelerate the most in 2021 relative to their 2020 numbers.

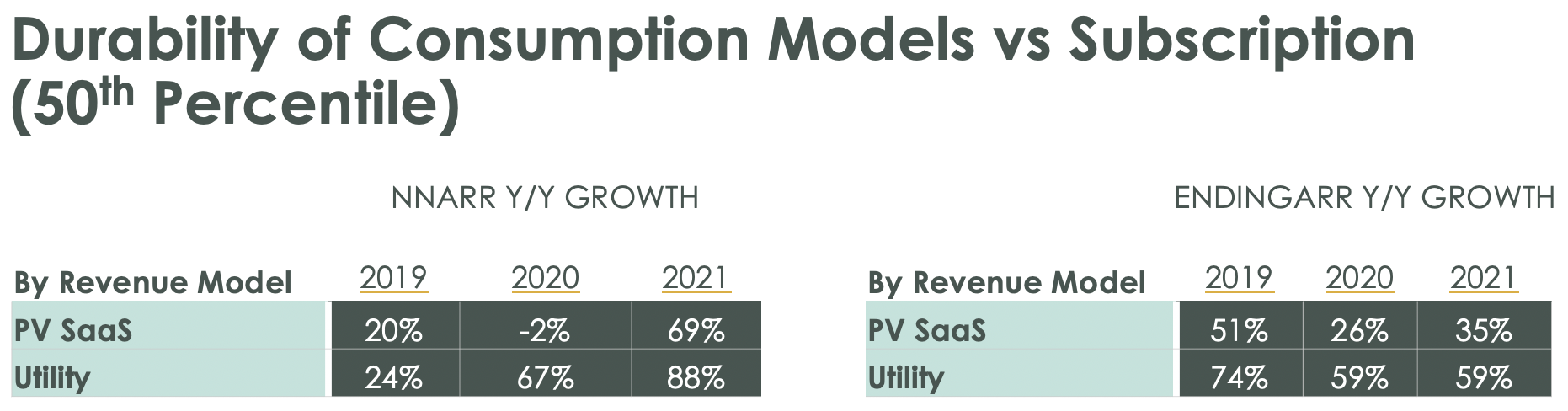

Utility Models Proved Highly Durable

We have seen an increasing percentage of our companies move to a utility model for pricing, where customers do not sign up for a fixed subscription but instead pay by the drink. This model has been made ubiquitous by AWS and further aligns the software industry around getting paid only for the value delivered.

The good news is that these models proved more durable in the COVID period than what we refer to as PV SaaS (Plain Vanilla SaaS). While ARR growth rates collapsed for the PV SaaS companies, the Utility model just powered through the year as evidenced by the numbers below.

Some of this could be a function of revenue reporting. Many utility models are moving away from an ARR measure based on new sales to one based on consumption, and so stalled new deals would not yet show up in the numbers.

Even so, the data is clearly a positive for the entire Cloud industry because it shows clearly that customers didn’t stop using software. Software made the cut when enterprises went through the exercise of defining what they would and would not consider core spend. Not at some level a surprise, but nice to see the hard data.

How Will 2021 Unfold?

At the start of the the FY 21 planning process in early November we wrote:

What we do believe is that for COVID-impacted companies that in Q3 if you have enough capital to take the risk, now is the time to start re-investing for growth. Most companies are leaning that way. Early discussions across the portfolio point to about a midpoint of about 60% Net New ARR growth for the year, up from 15% in 2020 but not back to doubling. The result is Closing ARR growth rate staying roughly flat at 60%-ish. We will report back as we see this evolve.

We are now reporting back. Plans in general are more aggressive than we had expected a month ago, with even the 50th percentile companies looking to go from 16% Net New ARR growth rate to 83%. Q3 definitely has been a shot in the arm for companies and there is clearly a belief that the worst is over and the bull case for Cloud software has been strengthened.

Broadly we agree, but with two caveats. The first is how realistic it is to rebuild capacity quickly enough to take advantage of the opportunity in H1 2021. We pushed our companies not to cut as deep as some were advocating in March, and we are glad we did that. But even so, most companies took out sales capacity that they are now having to rebuild.

The second caveat, which feels remote right now given the exuberant market, is how these plans would feel if Q4 comes in below plan or the economy tips down in Q1.

We will of course report on Q4 once the data is available in January.