Annual planning is on every CFO’s mind right now. We recently held a discussion event about planning for Scale’s Finance Community. What follows is a summary of that discussion including the slides we used during the event. I’m highlighting some of the actions and approaches I’ve seen really effective CFOs use when creating and presenting their annual plan to the Board.

The big theme of last year’s (2021) planning process was how much growth re-acceleration was possible coming out of COVID. As we showed in our blogs on Q3 2021 results and on the 2022 whisper numbers, re-acceleration happened in 2021 and companies are forecasting more of the same in 2022. Tellingly, the most uncertainty now is around operating expenses, with salary and hiring costs by far the biggest concern.

First things first: it’s a good time to be an enterprise software company.

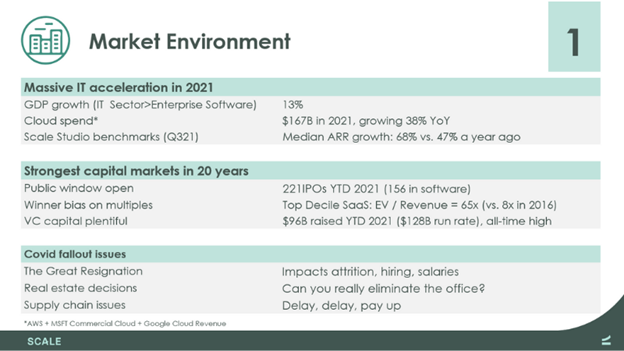

The market backdrop for selling enterprise software in 2022 is about as favorable as it gets. Some highlights:

- Enterprise Software outpacing GDP growth. The Enterprise Software segment within overall IT spending is growing 13% compared to global GDP growth of 5.6%. It reflects a ton of investment happening in business software. That 13% is well above historic levels.

- Cloud spending growing 38%. Enterprises will spend $167B in 2021 with just the Big Three of AWS, MSFT Commercial Cloud, and Google Cloud. Strong enterprise demand for software and digitization continues.

- Strong 3Q performance. Across SaaS, 3Q was another quarter of strong ARR growth and all signs point to more of the same in Q4 and on into 2022. We released a Q3 Flash Update with all the details.

- 2022 Whisper Numbers going higher. We recently released 2022 “whisper number” estimates, which are useful as a gauge of sentiment as CEOs and CFOs work on 2022 plans. The headline figure is an expectation for 80% ARR growth next year, up from the current 2021 forecast of 70%.

There have been 156 software IPOs so far in 2021 and, as long as multiple remain as high as they are (a stunning 65x EV/Rev for top decile performers), 2022 looks like more of the same. VC investment in 2021 is at a $126B run rate, an all-time high. Access to capital is not a problem nor is appetite for software IPOs in the public markets.

CFOs can do a lot to ensure a smooth approval process at the Board level. It starts with providing sufficient context (qualitative as well as quantitative) to anchor the Board on your point of view. A few things I’ve seen work:

Frame the big picture right away. Start the presentation with clearly stated objectives that you can link back to later when the conversation gets stuck in the weeds. If you’re investing heavily in product during 2022, for instance, state that clearly up front. Establishing the plan’s context early on helps everyone stay oriented on what you’re trying to achieve. Balance the qualitative (“Invest heavily in product”) with the quantitative (“Sustain ARR growth at 125%”). Remember to link to the CEO’s stated goals for the company.

Quickly get to key assumptions and projections. Another common mistake (in the sense that it slows everything down) is to structure the presentation with a big “reveal” of the numbers at the end. Don’t do that. Get started right away with the big picture and summary numbers. Ground the discussion early.

Be precise about “what you need to believe” for the plan to work. The KPIs and other data you use in the presentation should be the same KPIs your teams use to run the business. There shouldn’t be a translation step necessary to go from plan to KPIs. This makes it clear what numbers matter and what levers you have to work with.

Obviously the bookings number is by far the hardest number to estimate. You can make it easier to calibrate your plan with the Board by “showing your work”, which here means triangulating by showing multiple paths to your estimate. That might mean showing a calculation based on pipeline coverage, another using New vs. Upsell, and another based on a last year + X% method.

The CFO’s goal is to make everyone comfortable that your projections are doable. If you can dial in on the bookings number three different ways, you’re more likely to get buy-in from everyone in the room.

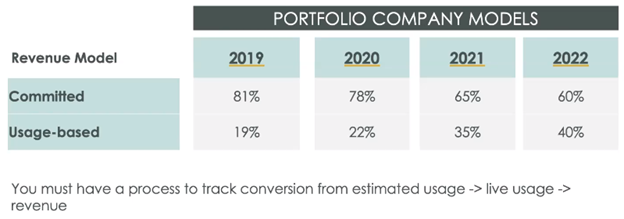

Another pain point is the bookings-to-revenue conversion rate. Many of our companies have moved from pure per-seat ARR models to some version of usage-based pricing. Take this and add implementation delays and you have the potential for a GAAP revenue miss, even if you estimate bookings correctly. It’s a miss we are seeing more often recently.

This is no longer a niche topic with usage-based SaaS on the rise. About 35% of Scale portfolio companies (going to 40% in 2022) have some portion of usage-based revenue. That’s up from 19% in 2019.

Gross Margin assumptions aren’t the quick check box they were even just five years ago. More software companies today have complexities like a hardware component to their product, or large upfront data costs for AI training, or complexities with how Customer Success expenses are allocated. From a Board member perspective, there’s also a lack of consistency in presentation across companies that makes this discussion harder. Double check your plan and presentation accordingly.

As I mentioned at the outset, the theme for 2022 planning is really this unusual uncertainty about Operating Expenses. Most years, the CFO simply shows fundamentals like headcount adds by quarter and the big numbers like S&M and R&D. This year costs like real estate and salaries require special attention.

Employment costs. The so-called “Great Resignation” has employees leaving companies at record levels. Stories of talent getting poached at 2 or 3x compensation are making the rounds. Going around the table we saw CFOs talking about a 10% salary and hiring cost increase next year. This is significantly above everyone’s mental model from the last five years or so, and Board members may struggle to digest (ironically, given venture dollars have helped cause the problem). We are going to try and get some hard data around this for our CFOs. Not only are employees costing more but they are harder to get! My guess is one of the biggest embedded risks in 2022 plans is an inability to hire at budgeted levels. You should think about how to de-risk this in your plan.

Real estate. A lot of the discussion and planning on your company’s post-COVID office space will be driven by 2022 planning. Companies are still figuring out the post-COVID office, with a lot of office space likely to come back online next year. Some companies may end up seeing cost savings (and thus upside) from real estate but the uncertainty makes it hard to plan for. We’re seeing CFOs doing a lot of work analyzing the true cost of remote work versus in-office, when factors like expensive company-wide offsites become needed to maintain culture and morale. (Incidentally, we recently led a funding round for VergeSense, which has a platform for identifying opportunities in office space usage.)

Pricing. The biggest aha I got from the event was the suggestion from one of the CFOs to look aggressively at pricing. Obvious when you say it, but it is always amazing how little time is spent on understanding pricing at the Board level. There is a strategic dimension to pricing and packaging but this year there is also the tactical reality that inflation overall is running currently at 6% and, as discussed above, salary inflation in tech could be even higher. Given that, it is hard for me to imagine approving any budget right now without a detailed discussion on what the company is doing on a price increase this year.

Stepping back, operating margins for the S&P 500 are higher than they’ve been in 20 years in part because a lot of large companies are successfully passing on higher costs to their customers via price increases. For B2B customers, Corporate America is the customer base and realistic price increases have to be on the table.

The approval process doesn’t need to be protracted. Anticipate what your Board is going to want to see before signing off on your 2022 plan. That package should include:

A multi-year plan that has some estimate of future cash needs. If for no other reason than it will make plan approval easier, provide a multi-year plan of cash needs that doesn’t just stop on Dec 31st 2022. It is very hard to approve a plan that shows a big jump in revenue, OpEx, and cash burn with a slim cash balance on Dec 31st 2022 and no estimate of future cash needs beyond that date. I can never decide if CFOs who do that are being passive aggressive or clueless but it doesn’t matter. Either way it is annoying. Please provide some high level of estimate of future cash needs. Ideally have a multi-year plan pretty much at all times. Yes it is speculation beyond the next year or so, but given that we are seeing funding rounds kick off on short notice, having a plan ready, and an explicit answer to the cash needs question, is a good idea. Not all Board members agree with me on this, as I have heard the pushback that a multi-year plan is too speculative but I personally believe that a competent CFO should a) always know when the company next needs to raise money, b) what the key metrics look like when that raise is required, and c) have a plan to get ahead of that fundraise.

A summary slide at the end followed by an appendix with additional details. You want a good summary slide on the screen when the presentation transitions to questions and approval. A summary slide with the big projections and the big assumptions keeps everyone focused on what’s important. Again this kind of advice sounds dumb but in every approval meeting there has to be this going around the room discussion to get buy-in, and it often goes best when the facts and key assumptions are right in front of everyone.

Venture firms are leaning in right now because they themselves need to put more capital to work. Aggressive growth is being rewarded, often in the tangible form of immediate inside financing offers, so take advantage of that openness with a well-constructed plan that makes approval as frictionless as possible.

In every budget approval meeting someone invariably asks some version of the question, “Is the company growing fast enough?” Sometimes I get embarrassed by how obvious the questions that we as Board members get paid to ask are, but that doesn’t mean the question has no merit. You should be able to answer that question and the answer should never be, “Good question, we will get back to you.” You should have had that discussion with your management team and be able to speak to the trade offs required for a higher (or lower) growth rate.

One of the main reasons we’ve invested so much in Scale Studio is that it’s critical to understand your performance relative to other, comparable companies. If you are able to benchmark versus similar companies it can ground the “Can you grow faster?” discussion in facts and true limits of what is realistic.

Stepping back, 2022 right now feels like one of those years where budgeting is hard but in an easy way. What I mean by that is that revenue growth is strong, capital is freely available, and there is less pressure than usual to show both growth and convergence on profitability. That is the easy part. The hard part is the pressure to grow fast is strong and the ability to hire the team to get it done is unclear. Balancing not growth vs. profitability, but growth vs. ability to hire will be the judgement part this year. My advice is to put some slack in those hiring budgets.

Finally, remember the world can change on a dime. When it does every Board member will promptly forget the “grow at all costs” advice and rediscover cashflow as a constraint. That may not happen in 2022, I have given up macro forecasting as a fool’s errand, but at some point it will. At that point be sure to have enough cash, which in turn means enough time to switch to a more balanced growth plan.

ANNUAL PLANNING RESOURCES

Scale has tools and resources for generating and presenting your company’s annual plan:

- A new Annual Planning Tool on the Scale Studio Tools page. The downloadable spreadsheet generates an annual plan scenario using just 4 data points and a lot of Studio benchmarks to estimate OpEx levels. The idea is to illustrate what a 90% percentile or 50th percentile performance would look like.

- Also on Scale Studio, new Board Deck templates that are pre-populated with performance benchmarks tailored to your revenue level.

- Scaling: Seed to Series A is a new content hub for founders leading early-stage startups.

- SaaS Metrics: Vital Signs, another new content hub, consolidates resources on running a startup using growth, efficiency, churn, and burn metrics.

- Annual Planning for SaaS Companies gives a Board member’s perspective on the planning process.