Scale Studio Flash Updates use preliminary financial data from a 20+ company sample of enterprise software startups to measure industry growth rates and the health of the SaaS market. Check out the 1Q21 and 2Q21 updates or go straight to Q3 below.

What You Need to Know Right Now

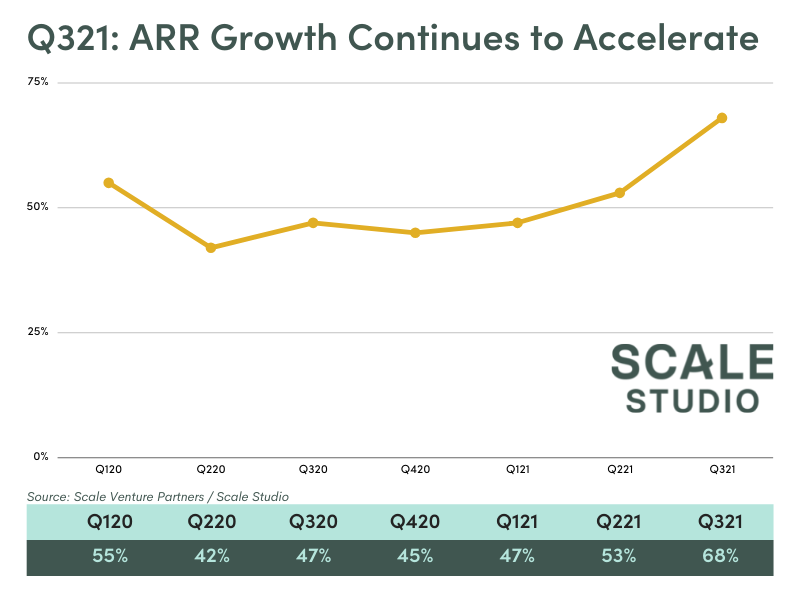

Early Q3 data indicates that year-on-year ARR Growth in Q321 once again shows sequential acceleration, eclipsing performance from the same period a year ago. The bar is getting higher.

Q3 PERFORMANCE HIGHLIGHTS

- Median Ending ARR Growth Rate hit 68% in Q321, compared to 47% in Q320.

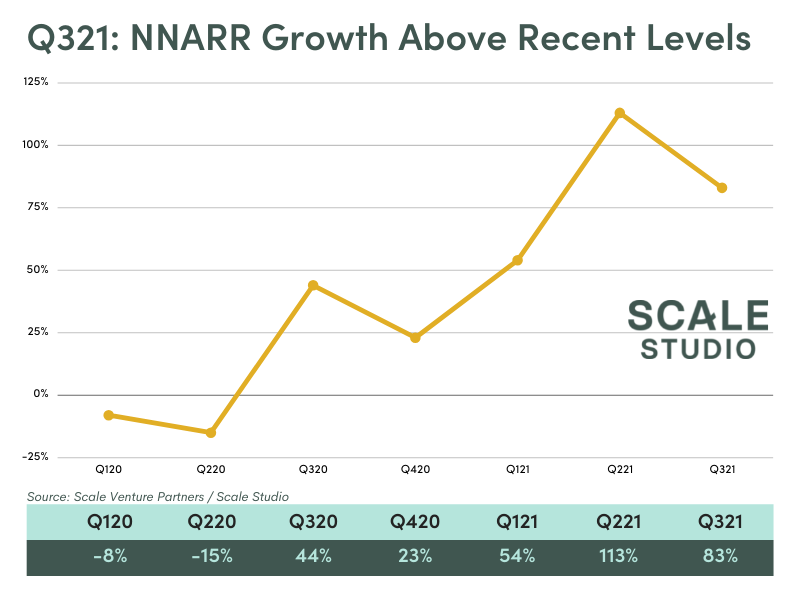

- Median NNARR Growth Rate hit 83% in Q321, compared to 44% in Q320.

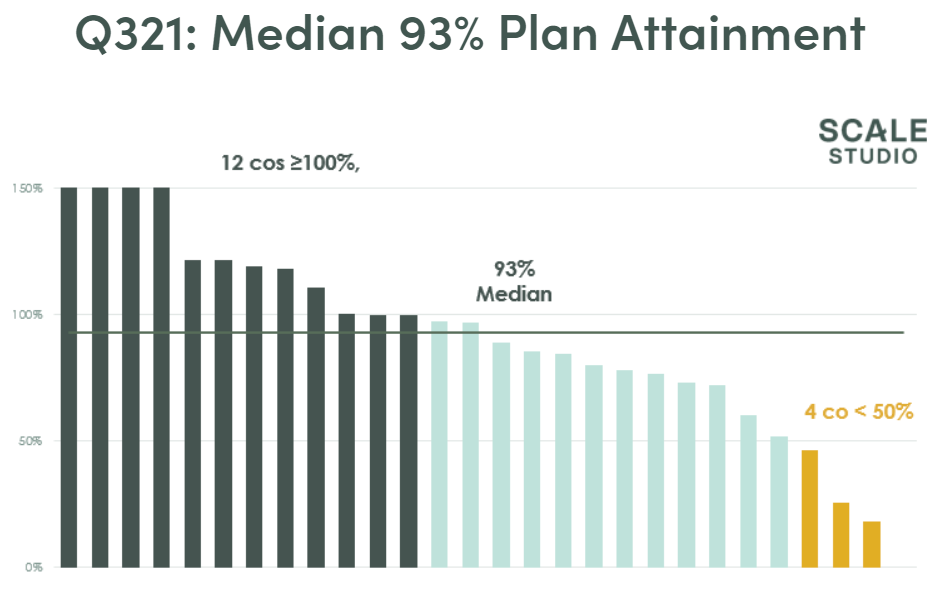

- Median plan attainment is 93% of aggressive 2021 forecasts (calculated as YTD ARR as a percentage of the company’s 2021 annual plan target).

Analysis

Twelve months ago, we witnessed one of the most miraculous business recoveries in recent history. Bouncing off the COVID-driven lows in the first half of 2020, last year’s Q3 rose from the ashes like the proverbial phoenix. During the first half of 2021, any year over year comparison to 1H20 was a bit of a layup. The low baseline set in the first half of 2020 combined with the juggernaut-like trend of digitization or die that fueled the enterprise software recovery resulted in some stellar results.

Third quarter is the first real test since the great reset. Based on preliminary financial data from 20+ enterprise software companies, we’re seeing continued strength as we head into the last quarter of 2021. It does appear that the industry, in some respects, is returning to pre-COVID norms.

What’s Good

ARR Growth: Median year-on-year Ending ARR Growth in Q321 was 68%, eclipsing the 47% median growth rate turned in during the same period a year ago. We’ve also seen sequential improvement in this metric since the COVID trough of 1H20. While part of this improvement is due to a strong performance in 1H21 (and aging out of 1H20), median growth in Q321 set a new high watermark for the metric.

NNARR Growth: Median NNARR Growth in Q321 was 83%, which compares favorably to the 44% reported in Q320. This number has also sequentially improved since the COVID trough of 1H20 (with the exception of a Q221 spike).

What’s Returning to Normal

Plan Attainment: In the first half of 2021, we saw record numbers of companies achieving (and exceeding) NNARR goals. During Q3 we saw a return to pre-COVID norms: 35% of companies achieved their NNARR plan targets; with 70% of the sample startups achieving greater than 75% of plan (that is, in the ballpark of what they projected for the quarter, back in 2020). Overall, median Plan Attainment was 93%, which is in line with the historical median.

Re-acceleration: We also saw a return to a typical mix of companies re-accelerating versus those that are decelerating. 32% of companies posted NNARR Growth Rates higher than their Ending ARR Growth rates – which indicates their growth rate is accelerating. This is in line with historical norms where about one third of companies will accelerate their growth rate in any given period.

With less than one quarter left to go in 2021, many companies have turned their attention to 2022 planning. We have resources that can help you save time: check out our 2022 annual planning advice or go straight to the new Annual Planning Tool on Scale Studio.

And stay tuned for our annual “Whisper Numbers” blog with data on what startups expect for 2022. If you’re curious, here is what startups expected heading into 2021.