Less than a year ago all our portfolio companies approved “normal” 2020 budgets under circumstances that now seem a distant memory. In March, most of these budgets got torn up and for some the focus was on survival. By June, it became obvious that tech was not going to just survive, but on a relative basis would thrive. Some companies, the COVID winners, are beating their original plans, and most companies have been meeting or beating their revised COVID plans from March. Most encouragingly, early Q3 results across the portfolio show some significant re-acceleration. (See the flash reports we published on Q1 and Q2; Q3 coming soon.)

Now all our companies are starting to turn their attention to 2021 planning. If the dominant question in March 2020 was how defensive should we be, the big budget question for 2021 is how offensive should we be. This is a nice but challenging change.

COVID Winners and COVID Impacted

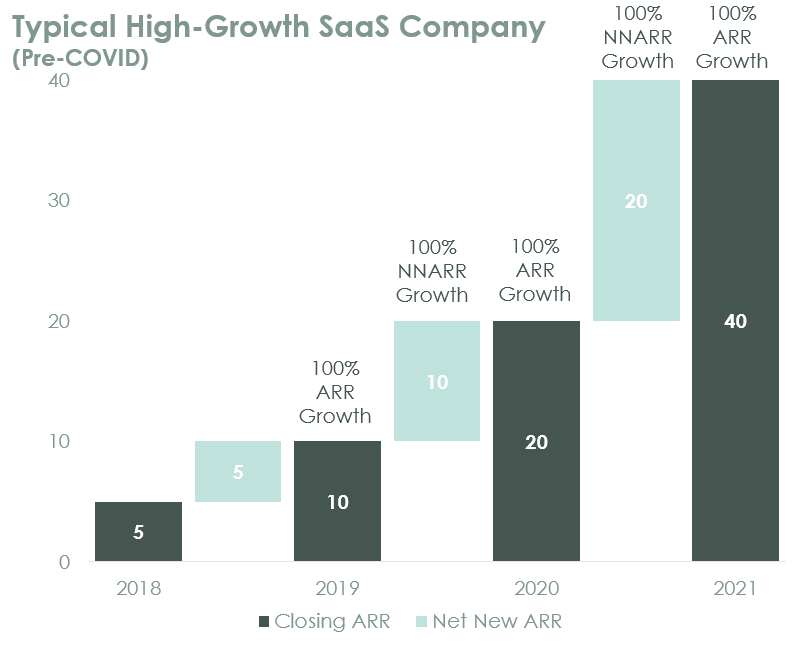

The first chart shows the plan trajectory for a best-in-class SaaS company coming into 2020. Net New ARR was forecast to double in 2020 as was Closing ARR. For about 20% of SaaS companies (the COVID winners), COVID did not change that trajectory and 2021 planning is pretty easy. You are winning, keep on investing.

However, COVID did have a real impact for most SaaS companies. Decision making slowed, big deals became harder to sign, and churn spiked. In response to the concerns in March, many companies also stopped adding new capacity which is now starting to impact sales. This is true even for many pure SaaS companies who are likely long-term winners from a COVID-reinforced continued move to the cloud. Short term for 80% of companies, COVID slowed growth.

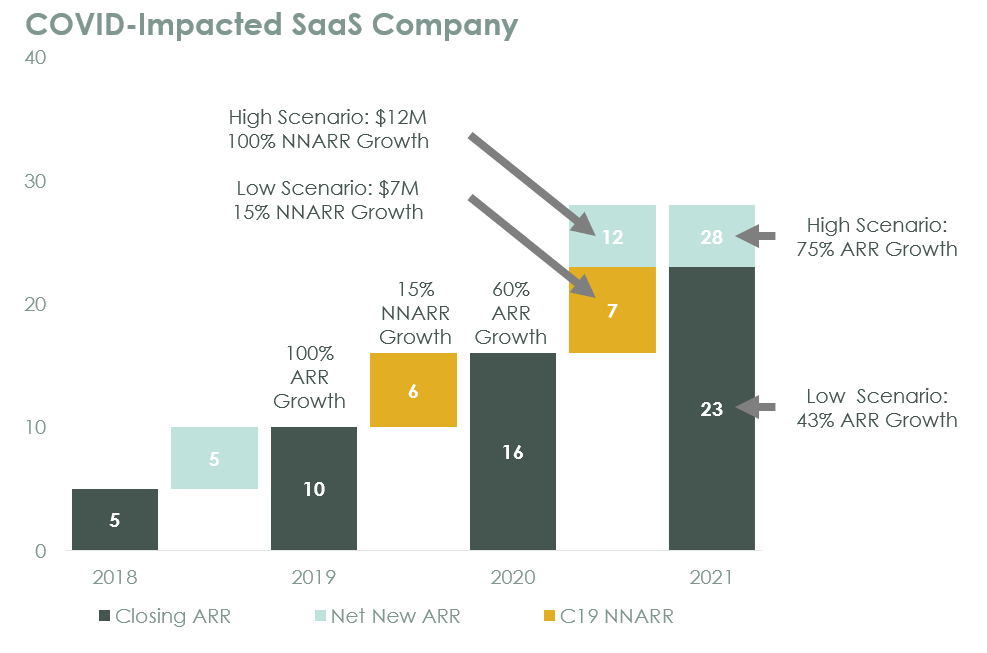

This slowdown does not show up easily in lagging indicators like GAAP revenue growth rate, or even Closing ARR growth rate, but it shows up clearly when we look at Net New ARR performance for FY20. Look at the example below showing the same best-in-class SaaS company from 2019 but with a significant COVID impact in 2020.

Net New ARR for FY20 went from a plan of $10M to an actual of $6M. The result is still ARR growth of 60% in FY20 (from $10M to $16M) but the growth rate of Net New ARR is only 15%, presaging a dramatic slowdown in ARR growth if this trend is not reversed in 2021. Across the portfolio (and recognizing that Q4 could still change this conclusion) this is roughly the median of what we are seeing as of Q3.

The chart also shows a range of outcomes for FY21. The low case is the bathtub recovery case: Net New ARR again grows at 15% to $7M and ARR growth slows to 43%. The high case is complete re-acceleration to 100% year-on-year Net New ARR growth of $12M. Of note, even in this case the Closing ARR growth rate is 75%, and Closing ARR is $28M down from $40M in the pre-COVID world.

Going into the budget process, every COVID-impacted company needs to figure out whether re-acceleration is even possible and, if so, what it will take to get it started.

Is Re-acceleration Possible?

Is the business environment and market for enterprise software picking up enough that it is even realistic to try for re-acceleration? The answer here is a qualified yes. I am done with weighting people’s opinions about this issue as being of any value — and so are most CEOs, having listened to the “end of the world” twaddle in March followed by the “Digital Transformation is making everything great” euphoria in June. Instead, let’s look at what we know to be true right now.

Our latest quarterly portfolio review shows a clear uptick in Q3. Two of the strongest signs of this pickup are:

- Year-on-year growth rates in Net New ARR have gone -13% in Q1, -15% in Q2, and +52% in Q3.

- Net Dollar Retention turned positive in Q3 at 104%, up from 95% in Q2 and 98% in Q1.

Things are definitely getting better and, at least for now, these are hard facts.

Re-acceleration Requires a Significant Change in Tempo

Net New ARR is a very leveraged number and the growth rate of NNARR is an even more leveraged metric. Net New ARR captures all the “work” taking place. New customer additions, upsells, and churn are all reflected in this number without the smoothing out denominator effect that you see in growth rates of Total ARR. NNARR is like an amplifier in a power circuit, making painfully clear the impact of deceleration in a way that a Closing ARR growth rate does not.

Getting NNARR growth rates back up in 2021 will require a sustained increase in sales capacity and pipeline generation. Given the lag in most software businesses from rep hire to rep productivity, this means you need to start now to have any impact on FY21.

There is a “flywheel” dynamic to growth. The COVID-winner company also has to double Net New ARR in 2021 but it is coming off a year when it has already doubled so the process is just “do twice as much of everything”. Hired 2x reps last year? Hire 2x more this year. Doubled pipe last year? Double it again this year.

For a COVID-impacted company, the period from March to September has been about flatlining, reducing capacity, and seeking to achieve a revised-lower budget. Now, as part of the budget process for FY21, the team has to raise their sights and think again about growth. This is why we think re-acceleration will require a top-down-driven change in tempo to start the flywheel moving.

Re-acceleration and Risk

We have seen a convergence on profitability across our portfolio in 2020 YTD, with median operating margins in 2019 around -100% and now clustering around -60%. This has been driven primarily by a slowdown in OpEx growth as a COVID response. Re-acceleration will require some increase in burn and the specifics by company of when that is possible based on cash availability are beyond this post.

What we do believe is that for COVID-impacted companies that in Q3 saw market signals comparable to what we discussed above, if you have enough capital to take the risk, now is the time to start re-investing for growth.

Most companies are leaning that way. Early discussions across the portfolio point to about a mid point of about 60% Net New ARR growth for the year, up from 15% in 2020 but not back to doubling. The result is Closing ARR growth rate staying roughly flat at 60%-ish. We will report back as we see this evolve.