Earlier this week I had the chance to sit down with Box CFO Dylan Smith and discuss how Box was able to dramatically improve their cost structure while continuing to innovate and grow in the face of tough competition. The learnings Dylan shared from the journey Box embarked on in 2020 are broadly applicable to the challenges tech companies are facing going into 2023. I invite you to listen to the recording of our conversation above.

A couple of quick highlights:

- In late 2019 Box had a clear growth strategy based on customer feedback, but at the same time had to significantly improve their operating profile and buy time for the strategy to take effect.

- Box turned around from growth of 8% and barely breakeven operating margin in 2020 to 17% growth and 23% operating profit in 2022.

- Clear scenario planning with the Board and management team was key to gaining trust and confidence (e.g., “if we only get $X in NNARR we’ll do Y, otherwise we’ll do Z”).

- Box cut overall headcount by ~10%, largely driven by rigorous sales performance management on the GTM side and focus on sales efficiency.

- Offshoring roles to Eastern Europe had little cost savings after accounting for travel and other costs, but was a significant talent lever.

- Box limited compensation increases while restructuring their cost profile. Retrospectively, this led to some unwelcome attrition of top performers – which could have been addressed by cutting headcount a bit more while keeping merit-based comp increases.

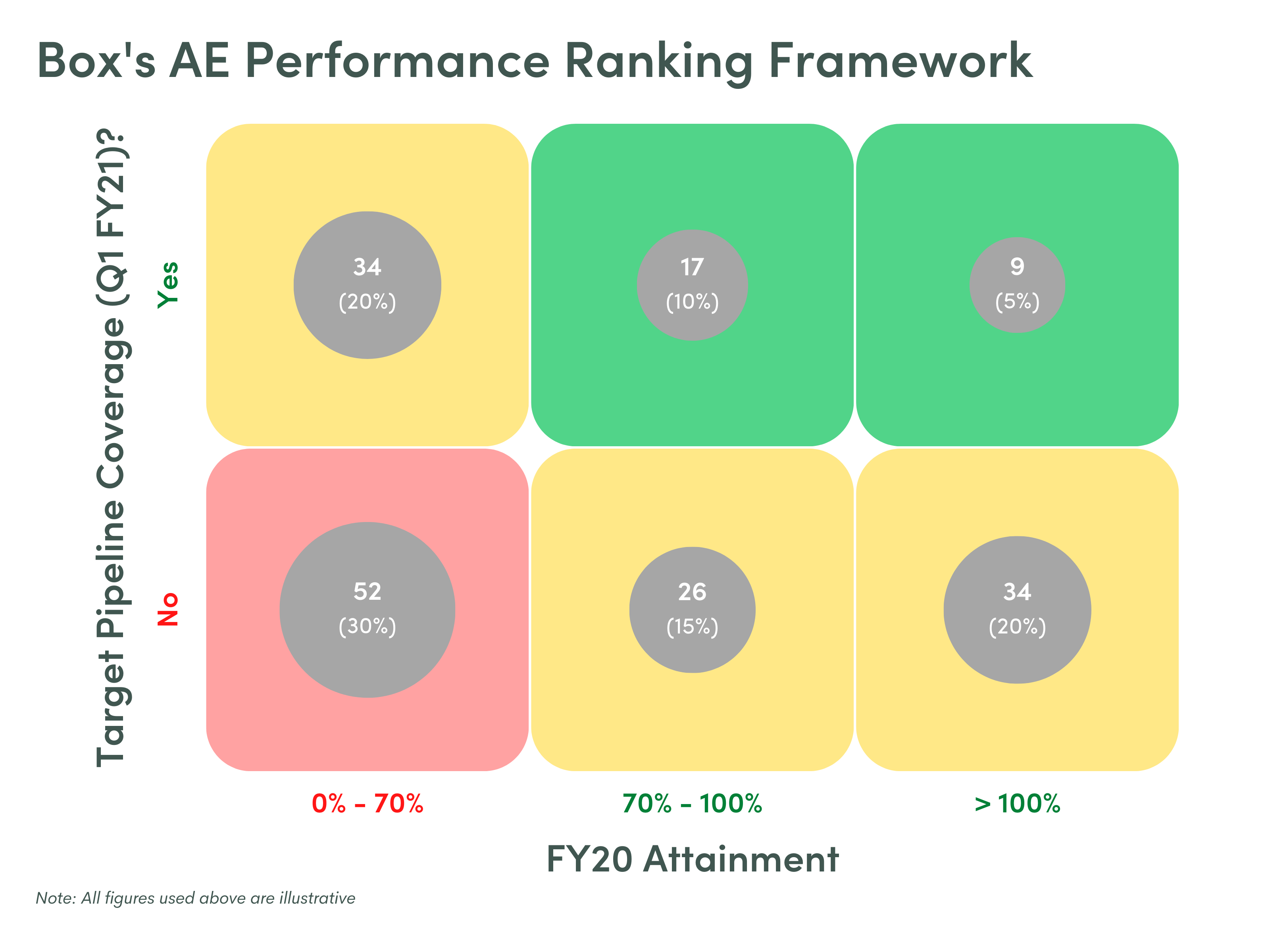

- Box adopted a “coverage vs attainment” framework for tracking sales rep productivity, which was used quarterly with both the board and management to track performance improvement:

You can find more details around Box’s journey in this blog post. Also, remember to check out our Annual Planning Hub for more helpful tools and resources.