During the last ten years, while venture capital was supposedly dying, the venture backed companies that went public or got acquired in that decade, achieved a combined valuation of $1.25 trillion as of Dec 31st 2013. Today, I wrote a column for Re/code explaining this. Check it out here. This companion post has the detail backup and an explanation of how the companies are categorized.

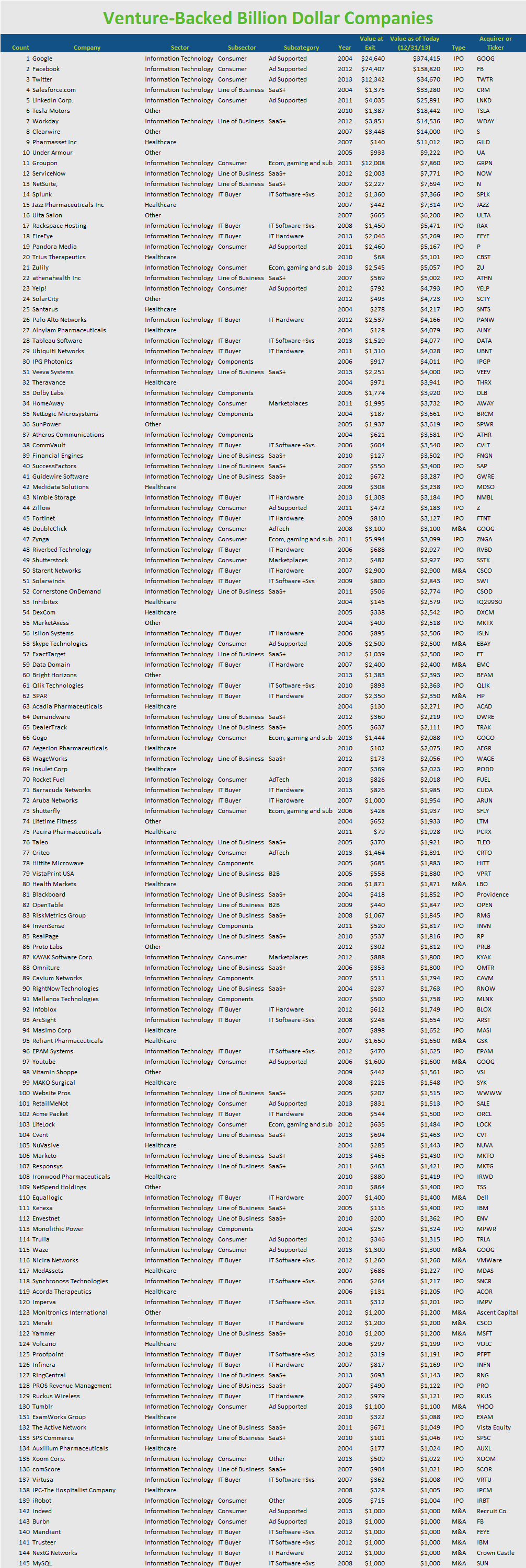

Here is the complete list:

What the Categories Mean

We divided all Companies up into the three obvious sectors based on where venture capital dollars flow: Information Technology, Healthcare and Other. Within IT, we think about businesses in terms of who is the customer, broadly defined. We have observed over the years that while technologies change, customer categories are more persistent. The CFO who bought mainframe financial software thirty year ago, SAP software fifteen years ago and Workday today, is the same person with the same purchasing process, despite all the technical change to the product. The process is still sales call, product review, Proof of Concept, Considered Purchase etc.

IT Categories Based on who the Buyer Is

We see four buyers types within the overall IT industry: the Enterprise IT buyer, the Enterprise Line of Business buyer, Individual Consumers and the Components buyer. Enterprise IT and Enterprise Line of Business are fairly straightforward Categories. IT buys databases, routers and PCs and the Line of Business buyer buys applications. The total of these two buyers is the overall Enterprise Technology business. In one sense Consumer is a misleading title. Most companies in the consumer category generate revenue by selling advertising against free consumer eyeballs, and thus strictly speaking the consumer is not the customer, the ad buyer is. However, we believe the core competence in an internet consumer company is the acquisition of vast numbers of end users by offering a compelling consumer product. Once you have done that, the monetization is fairly straightforward. So, while the “buyer” is not an accurate description, practically speaking it conveys the idea that the value is created for the company by attracting and pleasing the consumer. Finally, Components companies typically sell to a deeply technical buyer, building an electronics product that will embed the component, with either no attribution or at best an “Intel Inside” moniker. Most of these are semiconductor companies.

Dividing IT up Further

Within some of these Buyer Categories we have done a further analysis. While at first it felt like overkill, we found that we wanted to know the answers to questions like, “are the big wins in Enterprise IT Hardware companies or software companies?”. Thus for Enterprise IT, we broke it out into software/services companies on the one hand and hardware products on the other, recognizing that the distinction is not hard and fast – because everyone wants to say they are a software company. The answer BTW is hardware and software exits above $1BN are about equal in quantity over the past ten years. For Line of Business, we wanted to know how dominant SaaS is ? We broke out the companies into SaaS vendors and the rest. All but 2 were SaaS. Within the Consumer market we broke the companies into Ad Supported Models, Marketplaces and a few other categories. Almost all the value has been in large ad supported consumer focused internet companies which took the number one, two, three and five slots across the entire venture industry for the past decade.

The consumer category and subcategories is where is where you see start to evidence of “disruption” of the non tech economy. Consumer internet ad supported companies are taking old media ad dollars, marketplaces are taking share away from old ways of purchasing rental houses. In the next decade here is where companies like AirBnB and Uber will show up. This is the “Digital Disrupts Analog Trend”. It shows up as companies, focused on either the Consumer or Line of Business, that are not selling technology but instead using technology to disrupt an existing business. Many consumer facing businesses have already been disrupted but B2B has not seen the same effect. It will be interesting to see if that changes.

Comments welcome, and in particular any missing names. We run this exercise internally and call it the GED, the Great Exit Database. Don’t want to miss anything.