Large language models are poised to have an immediate effect on how businesses use software. While the exact scale and impact of AI is not a topic we aim to wrestle with here, the intuitive applicability of this technology across markets seems to have almost single-handedly pulled the broader startup community out of the post-2021 valuation hangover and back into an optimistic fervor. We’ve already seen rapid adoption and success of language-based technology in horizontal use cases like content creation for marketing, blogs, and email generation.

What is particularly impressive, however, is the ability of verticalized models to impact narrow, specialized use cases. For the first time, we are seeing software that is showing the capability to “eat (some of) the work” of white-collar jobs. The ability to understand the context of a complex query within a certain domain, integrate with vertical-specific datasets, and synthesize output is nothing short of revolutionary.

While not all verticals are right for venture investment, there are second-order impacts the introduction of LLMs have on the attractiveness of software markets, especially as it relates to growing the market size of an opportunity. Here’s how we’re thinking about applications of AI in vertical markets.

Evaluating the market

There are three key questions we ask ourselves in every deal before making an investment:

- Is this a category? In other words, is this a market that can support a venture-scale outcome?

- Is this company likely to be the winner?

- Is this the right price?

The category debate is the first and most important question to answer, and for companies engaged in category-creation, the one that requires the deepest research from our team. Understanding the market size today—and what it might become in the future—is critical to determining the attractiveness of an investment.

There are a few ways to calculate the size of a category, but a simple method for estimating Total Addressable Market (TAM) is taking the total number of potential customers and multiplying that by the average contract value (ACV).

Estimating TAM becomes even more important in vertical software markets, where by definition, there’s a finite set of customers a startup might sell to. For startups going after a vertical market, a bigger TAM generally equates to a larger outcome, and larger outcomes are more attractive to early-stage investors. Some verticals represent massive standalone markets like healthcare, insurance, or pharma with a high number of potential customers, whereas startups in smaller verticals need to think creatively on increasing their ACV in order to drive those outcomes.

Vertical SaaS + Payments

For companies operating in markets with constrained TAMs, continued growth requires adding new products to drive more revenue from each customer. For the last ten years, a consistent strategy for vertical SaaS players has been to layer fintech on top of their platforms. A well-documented example of a startup that did just that is Mindbody.

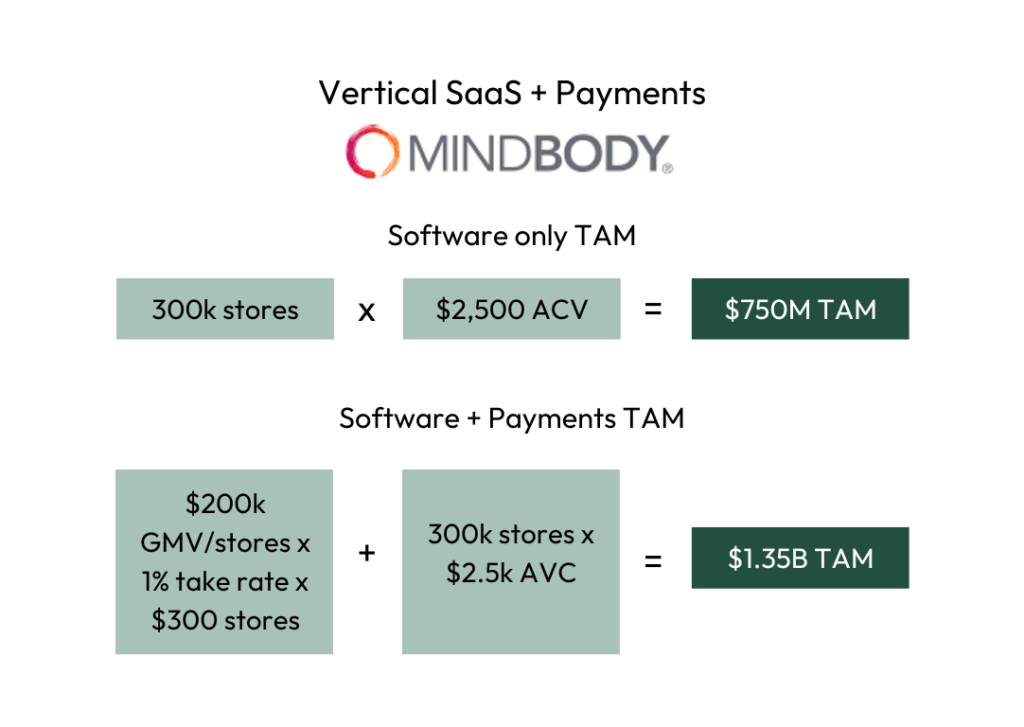

The illustration below shows how payments processing enabled Mindbody to collect payments for reservations through the platform, adding value to the customer and increasing their overall ACV.

Doubling down on payments increases MindBody’s TAM by roughly 80%, and it was successfully acquired by Vista Equity Partners in 2018 for approximately $2B. Plenty of other startups have followed this blueprint, and the pairing of vertical software and payments has proliferated, including in startups like Squire for barbershops, Shopmonkey for automotive repair, Toast for restaurants, and Archy for dental practices.

A New Framework for Vertical SaaS TAM

AI-enabled software is no longer just enabling end users, it is now beginning to obviate the need for them. LLMs are driving this advancement in technology, and we are already beginning to see the applicability of AI in text-heavy professional domains such as law, customer support, and even more creative disciplines such as design and software engineering.

If you are a buyer of software, your price sensitivity is dictated by the perceived ROI of the product. Software built for a specific vertical can generally command a higher premium than a substitute horizontal product (e.g., Veeva costs more on a per-seat basis than Salesforce), but per-seat or per-location software licenses have a price ceiling. LLMs are now beginning to automate the work in certain fields, and this has dramatic impacts on TAM. Vertical systems of record are giving way to vertical systems of automation and the increase in ROI for these AI-first products is suddenly making markets VCs previously considered “too small to care” much more venture-fundable.

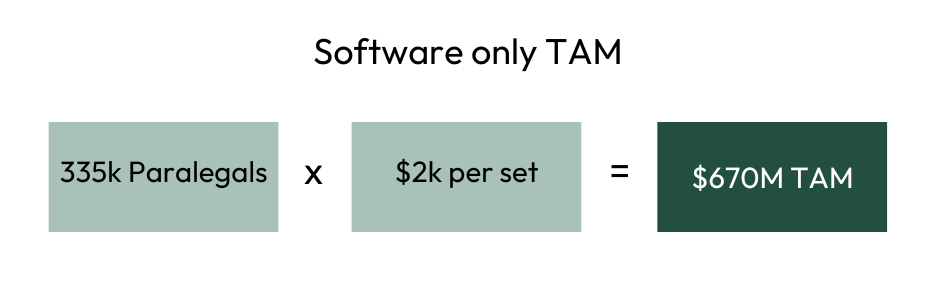

Early examples of LLMs automating the work of paralegals can showcase the impact AI has on vertical market size. There are roughly 335,000 paralegals and legal assistants in the United States, earning an average salary of $55,000. If you assume law firms are willing to spend $2,000 per seat per year on vertical-specific paralegal software (for reference, Microsoft 365 is $70 per year), this would imply a $670M TAM.

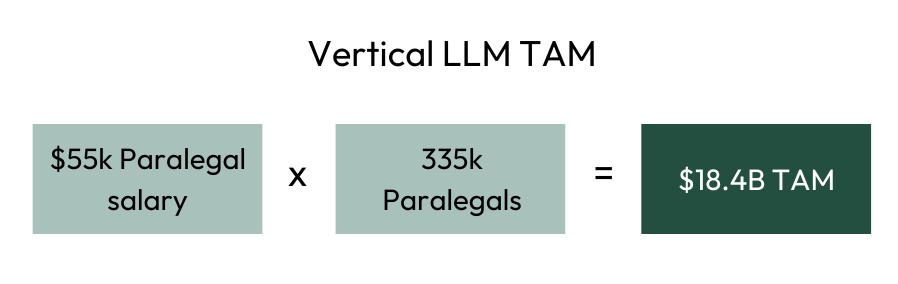

This is likely too small of a market to be a category, i.e. it won’t support a venture-scale outcome. But AI-first products in this market aren’t selling software to help paralegals do their jobs—they are automating the actual work itself. As a result, per-seat pricing sensitivity goes out the window. The total addressable market is now a direct function of the percentage of paralegal work a tool can automate. To put it another way, the new TAM is the combined annual salaries of the working paralegals in the US, or ~$18B.

Clearly, this estimate is overly large given it assumes all paralegal work can be automated (it can’t). But even if you were only able to automate 5% of the industry workflow, this would still be an additional $921M of market opportunity (5% x $18.4B), that, when combined with the previously presumed software TAM of $670M grows the overall market size to ~$1.6B, an increase of 138%.

Startups are finding early success with Vertical SaaS LLMs

Applications of LLMs in verticals dominated by white-collar professionals are not theoretical. The ingenuity of entrepreneurs in these markets is already manifesting in scaling products and there are a handful of companies such as Harvey AI and EvenUp that have begun to see early success enabling and automating legal workflows.

Advances in natural language processing are not just constrained to the domain of law – we are seeing additional opportunities surface in verticals such as freight (Vooma), accounting automation (Basis), insurance eligibility and billing (Health Harbor), and many others. While the increasing ability of software to understand language is going to have second-order and third-order effects that are difficult to comprehensively contemplate, for software companies operating within text-heavy verticals, we believe LLMs will open up venture opportunities and create new “sneaky big” markets. If you’re building in vertical SaaS with a focus on applied AI, we’d love to hear from you.