The IPO Gap Emerges

In the last post, I outlined how the IPO gap emerged after 2000. We went from hundreds of venture backed IPO’s in the late 90’s, to about fifty a year in the mid 2000’s, and finally none for most of 2009. This was a real problem. Lots of people are working on fixing the problem, but what DST did was figure out how to make money from it. DST realized faster and with more clarity than anyone else that just because the public markets did not want to “buy” IPO’s, did not mean that technology companies did not still need what IPO’s offered. Great high growth companies still had a need to raise $100 MM plus amounts of capital, to continue to grow, and early stage investors and employees still wanted to cash out. That was what an IPO was about, and the IPO gap was a financing opportunity.

Facebook, – Classic venture IPO of 2009 not, Large Cap IPO of 2012, yes.

Look at how Facebook was financed. Up until the DST financing, it followed the quintessential Silicon Valley funding strategy. The first round came from a super connected angel (Peter Thiel), followed by the first venture capital round from Accel Partners, a top tier firm. Once in revenue, Facebook raised a late stage round, at a huge(!)$500 million valuation, from Meritech Capital, and Greylock Partners and then took a strategic investment from Microsoft. Under normal circumstances the next step would have been an IPO. But the founder did not want to go public yet, and the markets in 2009 were choppy. What was to be done?

Seizing the Gap, – the DST story.

At this point Facebook needed someone who would pay venture capital like valuations but at private equity scale. Venture capital investors could stomach nosebleed valuations for great companies, but they could not write $100 million plus checks. US private equity investors could write $ 100MM and even $ 1BN checks, but were not used to paying 10x revenues for high growth companies. What was needed was someone with a venture like understanding of the value of high growth companies, but the financial heft of a private equity firm. “Cometh the hour, cometh the man” . DST knew social networks from their Russian experience, and had access to capital that had not been raised on a promise of doing all early stage investing. Investing at mutual fund scale but with venture capital returns looked fine to them. They made the Facebook investment in 2009 , and for the next two years they were not the only, but were clearly the largest player in the, “Feels like an IPO financing but private” game. They have made investments that will make them a fortune in companies like Facebook, Zynga, Groupon and now Twitter. It is not that the returns are comparable to early stage investing. Accel Partners will make between 500 and 1000 times their investment, compared to the 5x to 10x that DST will make, but 5x to 10x returns in three years, on big piles of money, is a pretty good living.

The gap is shut – Stuffing the Money in the good deals

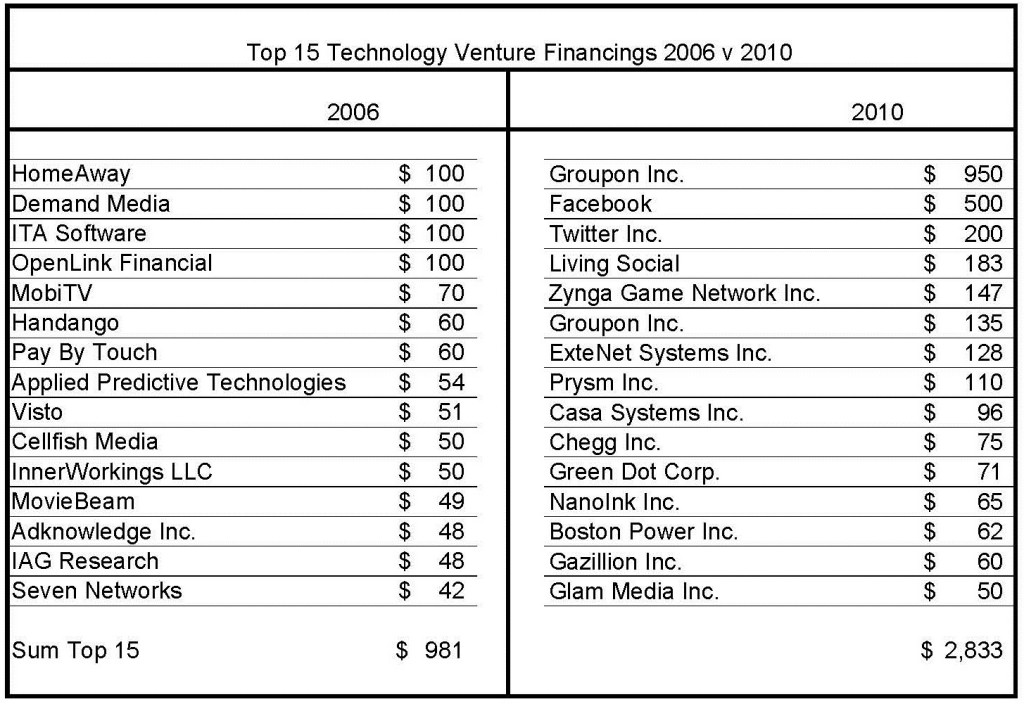

The gap is shut, not just because the IPO window is more open, (it is, though not yet back to 1990’s levels). It is also shut because many venture firms as well as mutual funds, have moved to grab the ultra late stage opportunity. Motivated in part by the survival gene, the industry has figured out that one way to put those “points on the board” is to be in the great deals, regardless of price. If that means morphing a firm from being an early stage investor, focused on doling out small amounts of capital and large amounts of value add, to being a passive late stage secondary purchaser of shares from the ex-employees of successful internet companies, so be it, “needs must, when the devil drives”. A 3x return off a $1BN valuation is still a 3x, and it can get a lot of dollars to work. The table below shows the fifteen largest venture financings in 2010, and compares it to the fifteen largest financings in 2006. The top eight deals in 2010 were all larger than the largest deal in 2006, despite 2006 being a much better overall economic environment. The top deal of 2010 is almost 10x the largest deal in 2006. Interestingly, the 15th largest deal in each case is almost the same size at approximately $ 50 MM. This illustrates the (unspoken) mission of late stage investing in the last two years, which has been to stuff every dime possible into five or six perceived super hot deals.

Where from here?

This trend has attracted notice and criticism (this article by Sarah Lacy covers the issue really well). My perspective is that the real question is how long will the strategy work ? Right now the 2009/2010 deals are clearly on course to make money, and what’s to argue about that. The strategy of piling into the super premium deals worked brilliantly when almost no one was pursuing it, was working well as long as only a few firms were doing it, and will end badly sometime in the next two years when pricing massively outruns value and the cycle goes round again. At that point the biggest negative of the strategy, namely that the dollars at risk are huge, will become painfully clear and someone will lose big. You cannot stop the cycle, but you can enjoy the irony. The attempt to protect US public investors from being duped, and the overall inhospitable climate in the public markets for higher risk technology companies, has led to a Russian venture capital firm making billions of dollars and turned many early stage venture firms into de facto mutual fund investors. Not what was intended, but money has its own imperative, and the DST strategy has totally shaken up the late stage game. Smart guys.