Scale’s quarterly Scale Studio Flash updates use our proprietary data platform, Scale Studio, to analyze a representative sample of enterprise software startups and provide a real-time look into industry growth rates and the health of the software market. Today, we explore the results of Q1 2024.

Q124 Key Findings

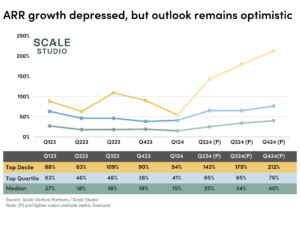

- Median ARR growth remains depressed at 15%, marking the 4th quarter of sub 20% growth

- Median burn rate improved by 13% year over year, a strong signal that companies are executing on the plans for efficiency

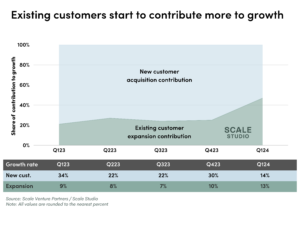

- Expansion ARR and New ARR contribute equally to growth, marking a shift in how companies grow and reflect how the tech sector continues to focus on existing customers to drive efficient growth

Median plan attainment is at 88%, a 21% increase quarter over quarter, probably more so because plans have become more realistic. No longer playing for hypergrowth, companies are setting more conservative expectations for themselves, and their investors. This reflects in the modest growth rates being observed this quarter. That said, there is optimism that the back half of this year will pick up.

Yet another year of efficiency

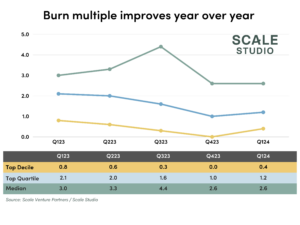

It’s like 2023 all over again. Tech companies continue to double down on efficiency. The RIFs of last year are seen in ever-shrinking burn multiples, and the boom of AI tools is probably contributing to an increase in productivity for leaner teams.

Median burn multiples improved 13% year over year while top decile companies doubled their efficiency in the same time period. While some hot AI companies are raising large rounds, fundraising overall has become more difficult, and startups are feeling the pressure to make the most of the money they already have.

Up[sell] and to the right

Before the start of the tech recession, SaaS companies prioritized adding new logos over existing customer expansion. But recently, customer expansion has played an increasingly important role in growth. In the most recent quarter, contribution of growth from existing customers was nearly the same as from new customers. This is a stark deviation from even the start of 2023 when new customers contributed nearly 80% of the overall growth number.

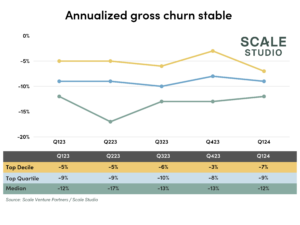

Churn also improved by a percent. While not an eye-catching number, it is an indicator that most players understand that it is cheaper and easier to upsell/retain rather than add new customers.

Despite a decrease in growth this quarter, the tech sector has shown a degree of resilience with players adjusting to the current market conditions. In fact, our data from Scale Studio indicated that a small subset of companies have generated operating profit in Q124. As we look toward H2, it remains to be seen if this new operating model of efficient growth is a recipe for success or if the excitement around AI startups reverts us back to hyper growth models.