Scale’s quarterly Scale Studio Flash Updates use our proprietary data platform, Scale Studio, to analyze a representative sample of enterprise software startups and provide a real-time look into industry growth rates and the health of the software market. Today, we explore the results of Q4 2023.

What you need to know right now

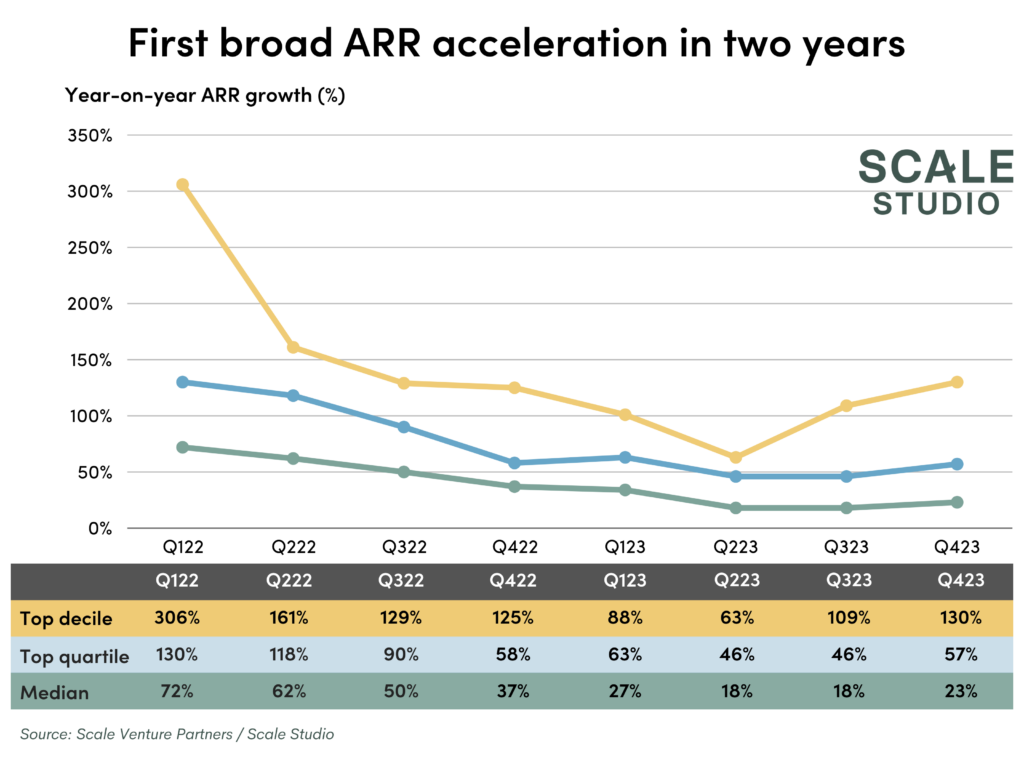

It appears that the tech recession is over. Preliminary analysis for Q423 reveals that private company ARR growth rates increased across the board for the first time in eight quarters. Median plan attainment rose from 42% in Q3 2023 to 70% in Q4 2023. Concurrently, median GAAP revenue growth also improved, marking the second consecutive quarter of quarter-over-quarter growth.

The performance in Q423 appears to be a continuation of the trends observed in Q323, where ARR growth rates began to stabilize. This improvement was driven by an increase in top-decile growth rates and a push towards efficiency. These developments, coupled with a strong performance in Net New ARR plan attainment, could be interpreted as the initial signs of a tech recovery.

The holistic view of Q423 metrics show the software sector is maintaining momentum from Q323, signaling that Q223 was a positive inflection point for growth. But, while the recovery may have started, the data so far is not enough to indicate an expected return to the hypergrowth of a few years ago.

Q423 Key Findings

- Median ARR growth rate was 23%, a 3% increase over Q323. This continues the trend of higher ARR growth rates started in Q323

- Top-decile ARR growth rate was 130%, a healthy bump over Q323’s reported top decile growth rate of 109%

- Net New ARR median plan attainment was 70%, significantly higher than the 42% achieved in Q323

Q423 growth rate analysis

A preliminary look at Q423 growth metrics indicates that we may be seeing the light at the end of the tunnel. As covered in our last flash update, we observed stabilization and a slight uptick in ARR growth rates following the bottoming out of growth in Q223. Top decile ARR led the charge this quarter at 130%, exceeding Q323’s top decile by 21%. Top quartile and median growth rates also accelerated in Q423.

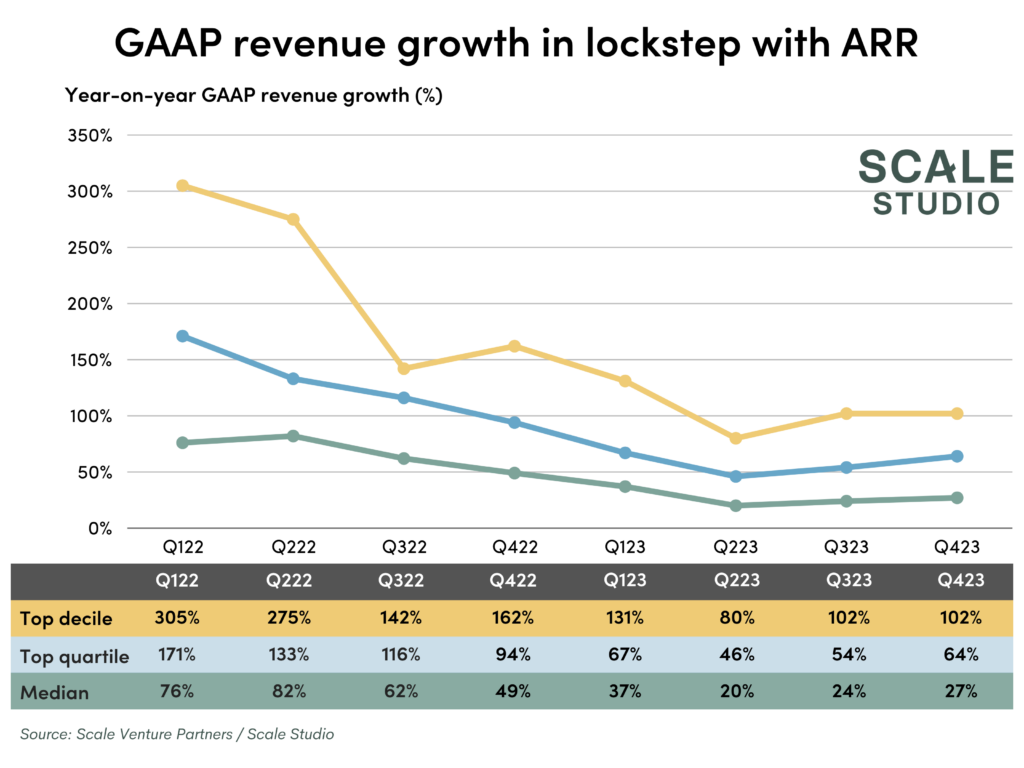

Looking at the graph below, we see the same narrative with GAAP revenue. The median reported growth was 23%, marking a 3% rise from Q323 following a 4% increase observed from Q223 to Q323. On a quarter-to-quarter view, top quartile growth increased 10%, while the top decile saw no change, remaining stagnant from Q323 to Q423.

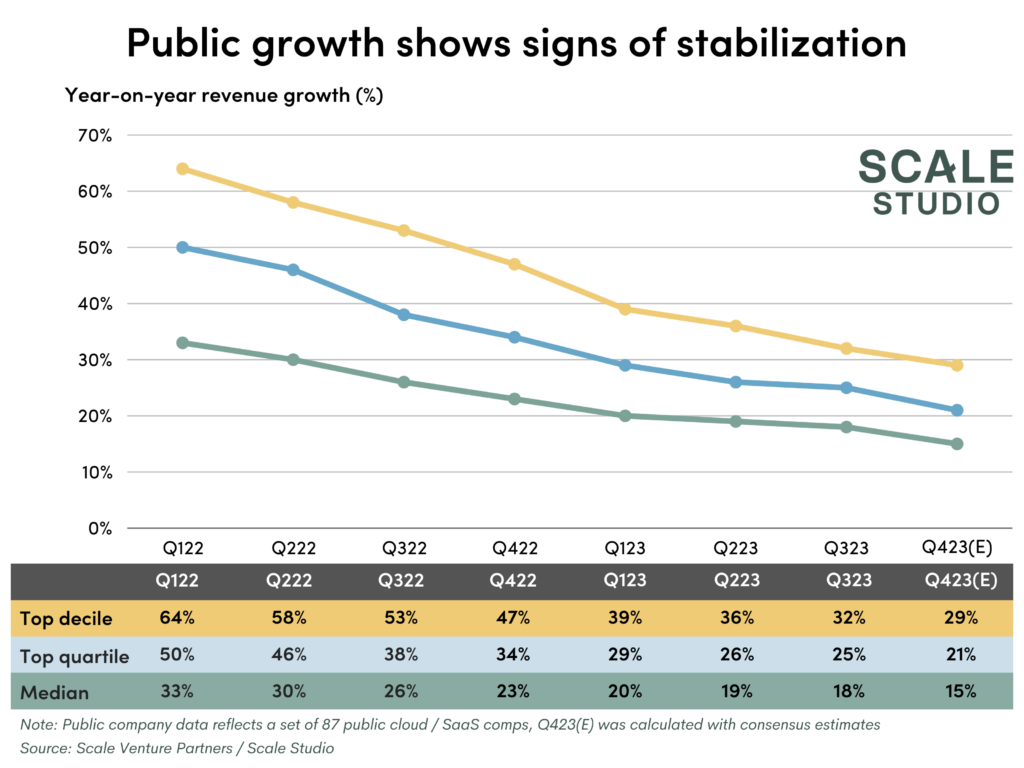

Public tech players are showing early signs of recovery

Analyzing the performance of public software companies reveals a trend that is weaker but similar to what we have seen above with private startups. (Note: public software company data is limited at time of publication.) Public median growth shows a positive trend quarter over quarter but, since Q323, top quartile has stayed flat and top decile growth has actually slightly declined. These metrics are not a huge departure from what we reported in last quarter’s flash report and seem to indicate that public tech players may recover a bit more slowly than their private startup counterparts.

The trend of measured improvement in quarterly growth, coupled with stronger NNARR plan attainment rates, indicates that while the industry is starting to recover, it may face a prolonged march out of stagnation, as opposed to a rapid snap back to hyper growth.