Author’s Note: A version of this article first appeared here in The Wall Street Journal’s Venture Capital Dispatch.

Venture capital returns are going up. That is the clear conclusion from two recent press releases: the 2010 fundraising data from Dow Jones, and the 2010 review of exits from the NVCA. Neither release reads that way but the laws of supply and demand make it, from here on in, pretty inevitable.

Looking first at cash invested into venture funds themselves, the Dow Jones press release shows that funding fell to “a seven year low” of $11.6 Bn in 2010. The real meaning of this becomes clear if you take a much longer perspective and look at venture capital funding over the past twenty five years and compare that to the overall size of the US economy. The assumption is that the best way to think to think about the supply of capital is in relation to the size of the overall economy and thus, the overall pool of likely opportunities.

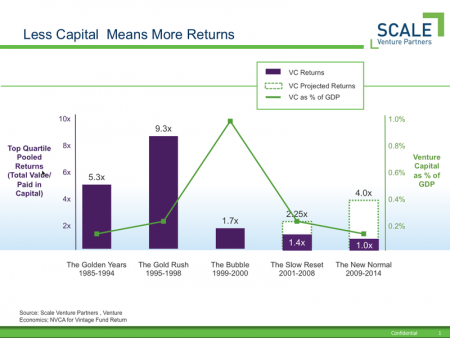

The single slide below tells the story. From 1986 to 1994, annual investor commitments to venture capital funds calculated as a percentage of GDP were under .1% of GDP. The result was a positive investment climate when venture funds delivered significant returns to investors. The average return of the top 25% of funds, (i.e. the return of the best funds) was 5.3x in that period. Call this the real Golden Years of venture capital. In 1995, the rules changed with the Netscape IPO, and the result was the Gold Rush period. Even though the capital invested doubled, the hugely strong IPO market meant that returns soared to 9.3x invested capital, an almost unheard of rate of return for any asset class. Capital poured in until inevitably, the rush of hot money killed the business off. In the year 2000, capital invested was 1% of GDP (or ten times the rate it had been only a few years earlier) so once IPO’s stopped, returns plummeted. Most of these funds have not yet returned the capital invested in them, and our estimate here of a 1.7x for the top quartile strikes most LP’s we talk to as optimistic.

The eight years from 2001 to 2008 has been the period of the Great Slow Reset. Unlike the public markets which can mark to market every day, private equity has ten year commitment periods and four year “re-up” cycles as venture funds seek new commitments. It also takes at least five and maybe ten years for it to be clear that an investment strategy is working or not. Throughout this period, every existing venture firm raising money has been able to justify the often abysmal 2000 fund by referring to their funds from the mid late 1990’s that delivered off-the-charts performance. Faced with this, most LP’s have understandably chosen to hang with the asset class. As a result, dollars raised as a % of GDP fell sharply in 2001-2002 as the obviously bad or new venture funds were killed, but then from 2003 onward, capital inflows roughly stabilized. Any existing fund with a decent 1990’s track record was able to soldier on. Throughout this period, capital raised as a percentage of GDP ran around .2% of GDP, still twice the relative amount raised during the Golden Years. The result, we believe, will be really solid returns from the top quartile of funds but probably not equivalent to the returns from the 1985+ time frame. (The 2.25x felt high when we first built this slide a year ago. It feels a little low now, but 3x is probably the upper bound estimate).

The game changed in late 2008. The Lehman collapse brought home to investors the real cost of illiquidity when you actually need the money. In addition, the warm afterglow of the venture success in the 1990’s faded as the decade slowly disappeared from the ten year return statistics which are used by many institutions to decide whether to invest in the asset class or not. In 2009, venture funds raised $13.5 Bn, well below .1% of GDP. The big question at the end of 2009 was whether the funding numbers represented a one-off dip in a dreadful year or a trend?

Now we know. In 2010, despite being a better year for equities and for technology, the result was a further reduction in venture funds raised to $ 11.6 BN, equal to .07% of GDP. I believe that the venture capital industry is due for a multi-year period where the dollars raised by the venture industry will be at or below the .1% of GDP level. The same institutional realities that made the industry slow to correct over-funding in the last decade will make it slow to correct under-funding in the early part of this decade. Those forces, driving lower capital commitments to the venture industry, will not change until the returns send an unequivocal “reinvest” signal back to the investors; in other words, more money will come back to the system only once the returns show sustained improvement.

An implicit assumption here is that the opportunity for innovation remains roughly constant relative to the size of the overall economy. I clearly believe this is the case. GDP growth, driven in large part by technological innovation, has been pretty consistent for as far back as meaningful economic data has been recorded in the US. It is always possible that this has changed, but I doubt it.

On the exit side, the NVCA press release elegantly describes the situation as having improved “from abysmal to viable”. The base numbers support this. I believe that the “real” exit environment, or more accurately the pace of value creation in the venture business, is significantly better than is shown in the exit numbers, (and may try and explain this in a later post), but the numbers shown in the press release make the case adequately for now. The total value of M&A outcomes for venture backed companies was $ 18.3 Bn in 2010. If you assume the venture investors owned 70%, on average of these companies, this would imply that $12.8 Bn of value was returned to the venture investors. On the IPO side, 72 IPO’s raised $7 Bn. Again, using rough math of a 25% dilution from IPO, and a 70% pre-IPO venture ownership, the result is a further $14.7 Bn of venture value creation. The result overall is approximately $ 26.5 Bn of value realized, well above the amount committed in 2010, but probably only keeping pace with the commitments in the 2006-2007 period when these investments were originally made. We are slowly climbing out of the hole.

What this adds up to is a commitment level of dollars to the venture industry that is now at or below the level that has previously generated compelling returns with no sign of that changing quickly, and an exit environment that is improving but is not yet anywhere close to a bubble. The result has to be a prolonged period of scarce capital, and scarce capital makes profitable capital – just as plentiful capital in 2000 made wasted capital.

This conclusion seems contrary to a number of recent articles. Fred Wilson has written a great post about bubble valuations and how his firm is thinking about it. There is widespread talk about a Super Angel bubble and more broadly, a Web 2.0 bubble. I would agree that the two “hottest” trends right now are: (1) Super Angels doing ultra-early stage investments looking for the next 1000x first round investment in Facebook, and (2) former purely early stage venture firms and as well as crossover investors looking to get access at perceived Web 2.0 winners at almost any price, (see Facebook, Groupon, Twitter). Even if you assume that both of these trends represent “bubbles” (and I am not making that call in this post), in aggregate, it amounts to maybe 20% of the total venture industry.

Across the whole venture industry including clean tech, life science and information technology, there are markets that are cold where prices are plummeting, parts that are lukewarm, and parts that are super hot. Price is doing what price is meant to do within the industry, sending a signal to invest less in solar panels and more in social networks (the market does not make value judgments). At the same time, price has done what it is meant to do for the venture industry as a whole, it has sent a signal to investors to withdraw capital – they have done so – and the result will slowly but inexorably be better returns for the industry as a whole. Venture returns are going up.

Post by Rory O’Driscoll, data from Scale Venture Partners, Dow Jones and the NVCA. Invaluable assistance from my partner Kate Mitchell, current Chairman of the NVCA. All opinions are solely those of Rory O’Driscoll and are not endorsed by anyone, even his immediate family. Comments welcome, in particular arguments against. I really believe the above is correct and I am investing my capital and my time accordingly. If there is negative data, I want to know.