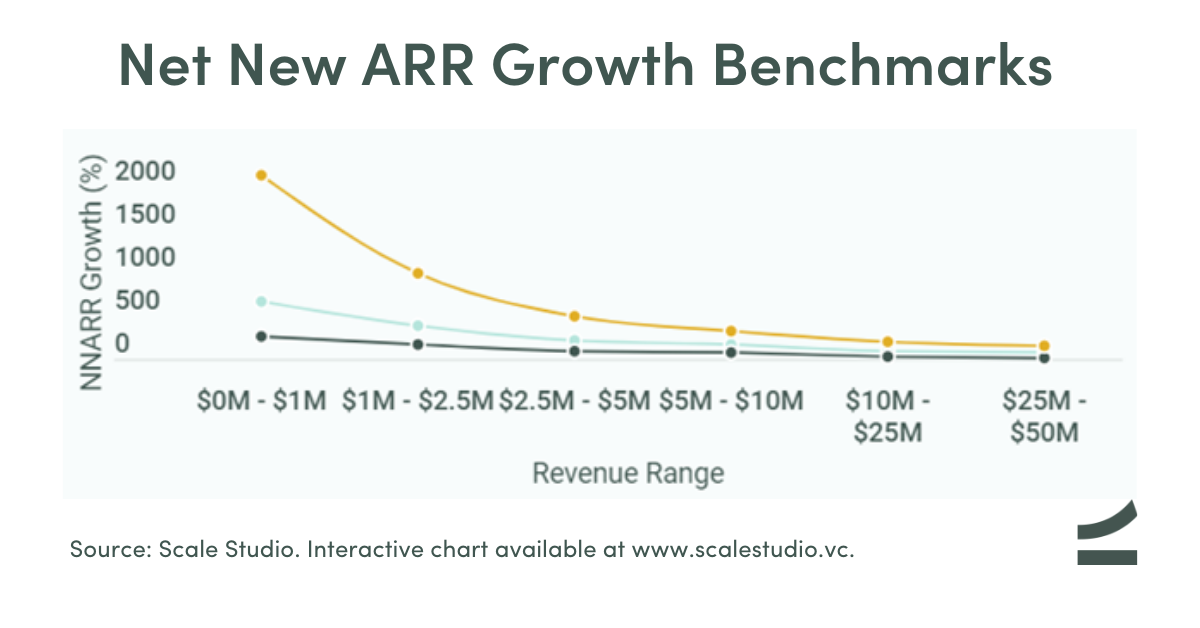

What is Net New ARR growth and why does it matter? It’s the growth metric that gives you the best view into your future growth.

In a recurring revenue business model, annual recurring revenue (ARR) grows every year by the net difference between the additions (new sales, upsell, expansion) and the subtractions (churn, downsell). Net one against the other and you have your NNARR. And it matters because it’s the single best indicator of your company’s future growth.

The formula for Net New ARR growth rate goes like this:

We say “crystal ball” because NNARR captures all of the work your company is doing to win, retain, and grow customers. When NNARR growth rate is higher than your ARR growth rate, all of that work means your future growth will accelerate.

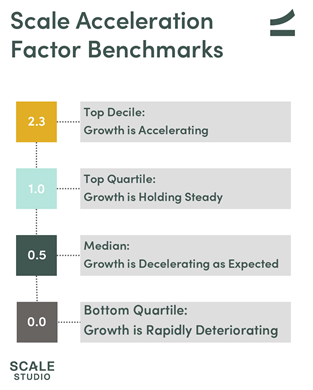

With the concept out of the way, we can look at some real data to see what makes for strong NNARR growth. Start with a metric we call the Scale Acceleration Factor: divide your NNARR Growth Rate (for a quarter) by your Ending ARR Growth Rate for the quarter. A ratio of 0.5 is median performance where growth is decelerating at an expected pace. Above 1.0, your startup is maintaining or outright accelerating future growth.

In our experience (and validated by Scale Studio data), only about 25% of companies are accelerating their growth trajectory. If you’re in that group, move that growth slide to the front of your pitch deck because investors are going to sit up and take notice.

Founders’ resources on growth rates: