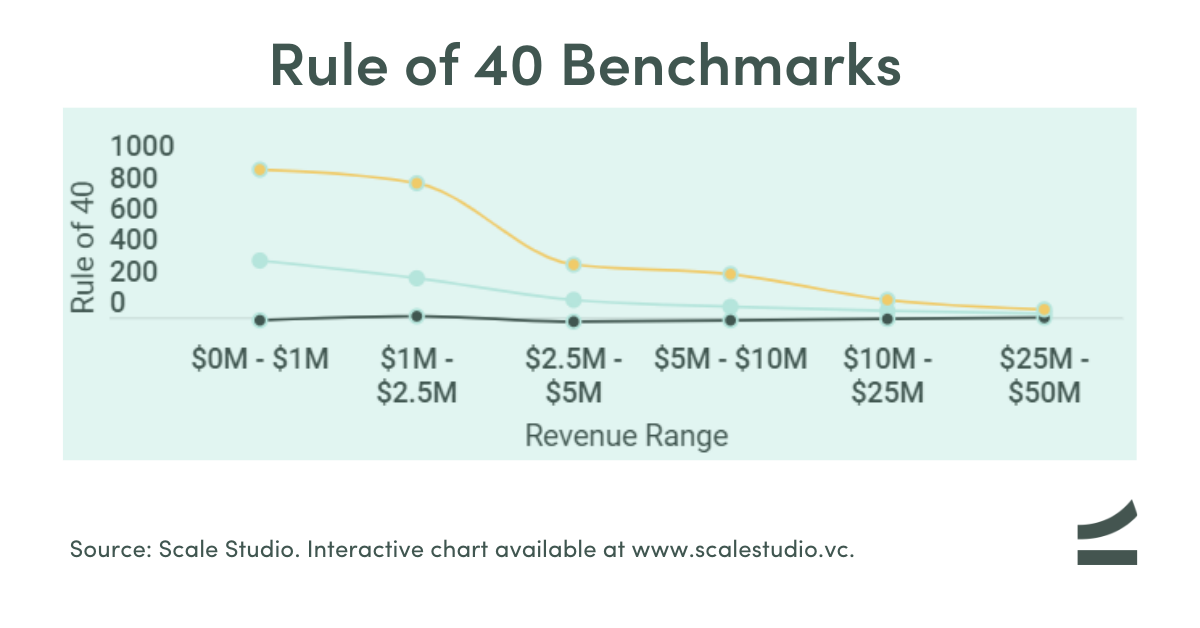

There’s a lot written about the Rule of 40 that applies to public companies and late-stage startups. Which begs the question, is it useful for early-in-revenue startups? Let’s take a look at the numbers.

The Rule of 40 boils down to a rule of thumb that a company’s revenue growth rate plus its profitability margin “should be” ≥ 40%. Its formula is as simple as:

We think the Rule of 40 is a fine rule, just not for venture-backed startups and certainly not for any company still perfecting its go-to-market strategy.

But there are two things that founders should keep in mind about the Rule of 40:

- It becomes relevant when your company approaches IPO readiness; the Rule is used by some analysts and bankers to compare software company fundamentals.

- It’s a persistent reminder that profitable growth is a long-term goal; thinking about your company’s business model at scale is certainly valuable in the early going.

There’s no getting around the simple fact that venture-backed startups need to optimize for growth not profitability early on. Conceptually, investors often see themselves as underwriting that growth because high growth signals a company has a high-value product and a large addressable market.

With success (and scale) comes a natural slowdown in growth rates, and along with that a shift in focus to factors like market expansion or cash flow growth. Keep the Rule of 40 in your back pocket for when you start thinking about your company’s IPO.

Further reading on SaaS P&L and startup burn rates: