Participation with No Cap (a.k.a Unlimited Double-Dipping!)

We talked about the base case with non-participating liquidation preference in volume 1 of this guide, and in volume 2 we added seniority to our cap table to understand its effect. Now, it’s time to get into the more onerous preference of participation. When we walked through the proceeds distribution before, the logic for each series was to determine if investors would receive more returns by keeping their preference or by converting to common shares. At the core of it, they had to make a choice.

With participation, they don’t have to make that choice and can get their preference while also participating in any common. Essentially, these series are double-dipping! This significantly juices the preferred returns of these participating series and reduces the non-participating preferred series and common returns.

There is also a mechanism called a participation cap to attempt to limit the consequences of participation on the rest of the shareholders. Think of no cap as unlimited double-dipping versus a cap as double-dipping to a certain point. When a cap is introduced, the analysis becomes much more complicated, so let’s first start with no cap in this guide, then in volume 4 we’ll walk through participation with a cap.

This guide is to empower founders, VCs, and others in the ecosystem to better understand how structure proposed by investors will affect the cap table and distributions. The key questions we’ll answer in this volume are:

- How do we account for these two participating preferred series receiving their preference and common, no matter what?

- How does this double-dipping impact the rest of the shareholders?

The Excel template for this example can be downloaded here.

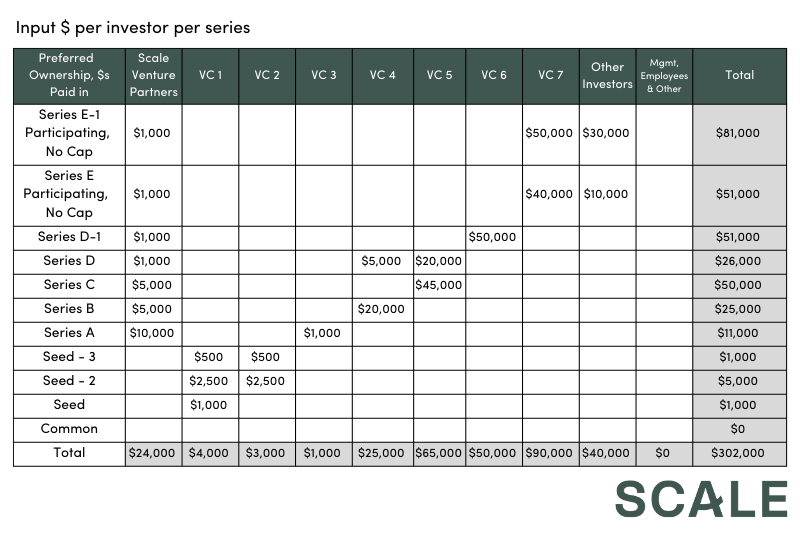

For this guide, we’re going to take the same cap table as we’ve used in the previous two guides, but instead of the top two series (series E-1 and E) being senior preferred, they are now participating with no cap. This means that they don’t have to choose between receiving their preference and participating in the common proceeds.

Adding Participation Changes the Conversion Points

This analysis starts the same as the base case in volume 1. First, put the inputs into the Excel template and then figure out the conversion points for each series. All the fields we calculated before will still follow the same logic, but with a few nuances that are critical to understand.

Since the uncapped participating series are always participating in common and always have their preference, we need the other series to account for that in their conversion points:

Point of Conversation for the two series with participation

For non-participating series it always comes down to a choice – take their preference or convert to common. A series with participation and no cap never has to make that choice. They always get to double-dip. This means that their conversion point is zero (0) and they always participate in the common by definition!

The non-participating series have the same logic as we reviewed in the previous two guides, but they now need to take into account the 2 series with participation. Because the two uncapped series always participate in common, that causes the non-participating series to have lower common ownership and a higher conversion point. Basically, when they convert, their ownership percentage is lower, which means the bar for them to convert is higher.

Ownership of common

To calculate when each series converts, we need to know what ownership of common they will have when they convert. In the last two scenarios (base case and seniority), the logic was straightforward. For each series at their price per share (PPS) at Conversion Point, just compare it to the other series’ PPS at Conversion Point to see who else will convert at that point.

Because uncapped participating series double-dip and always participate in common, we always need to include them in the share count.

In the template, the formula is changed so it always checks the conversion price against the other series to see if they convert and if their shares should be included, but also always includes the share count of the two uncapped series.

Since the two uncapped series in the previous scenarios were typically the last to convert, this has the effect of reducing the other series’ common ownership and thus increasing their conversion points compared to what they were in volumes 1 and 2.

Remaining Preference

Similarly, when finding the remaining preference we were again checking to see if the other series’ converted at the PPS at Conversion Point for each series. Just like with the ownership of common, we need to recognize that the two uncapped series will always take their preference. In the template, the formula has been built to always check the conversion price against the other series to see if they convert and if their preference is still remaining, but also always includes the preference of the two uncapped series.

Since the series E-1 and E in the previous scenarios were typically the last to convert anyway, their preference was already factored in for the other series in the previous scenarios, so this doesn’t have an impact here. We will see later on how these two series always getting their preference affects the other series.

After we have the conversion points for each series, it’s on to the distribution. We’ll break it down into proceeds taken by preference and then by common.

Preference taken

To keep things somewhat simple, let’s again assume Pari Passu and no seniority in this example. We will use the original logic and formula for the non-participating series which, again, has logic to determine for each series if they take their preference or convert to common. This logic hasn’t changed, although their inputs have been adjusted above and they now have a higher conversion point due to the participating series.

For the uncapped participating series, we need to tweak the formula to make sure they always receive their preference.

- The first part of the logic and formula is the same. You need to check the remaining consideration against the total amount of preference. If the remaining consideration is less than the total preference stack, then you multiply the series percent of the preference stack by the remaining consideration to get their prorated preference. Again, this is specific to Pari Passu.

- Once the remaining consideration is greater than the preference stack, then each investor would be able to get their full preference. Since these series have participation with no cap, they will always get their full preference moving forward. Remember: they have no decision to make and always double-dip!

Shares Participating in Common

For both the non-participating and participating, the formula is the same as the base case (volume 1). This is because the formula only has the share count when the remaining consideration is greater than the conversion point, and for participating series without a cap, the conversion point is zero! That means no matter what the consideration, the participating series will always participate in the proceeds that get distributed to the common. To be clear, there may not always be proceeds distributed to common, but if there are, these participating series’ will get a portion.

The calculations to find the common proceeds, total proceeds, and payouts are exactly the same, so we’re not going to rehash that (See volume 1 for a refresher).

How Participation with No Cap affects distributions

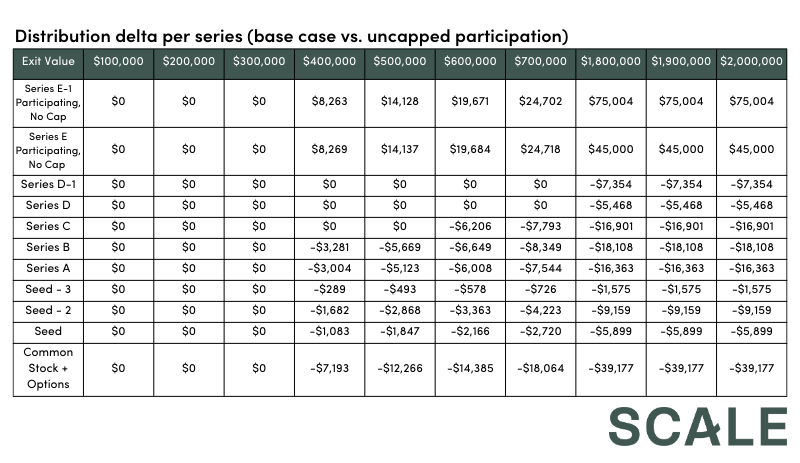

In volume 2 we learned how seniority affects shareholders’ returns. Now, let’s look at how Participation with no cap changes things. Below is the delta in returns from this uncapped participation scenario vs. the original base case scenario of non-participation (returns in this scenario with uncapped participation minus the returns in the base case non-participating without seniority).

Remember, the concept of participation is about double-dipping. When there are no common returns to double-dip into, then it doesn’t matter. This is why, when exit prices are low, this does not affect the returns for any series’.

To make this more concrete, look at the series B in the table above. They have the same return at a $300M exit whether the series E-1 and E have participation or not. This is because the total consideration is less than the total preference stack ($302M) so all series are still taking their preference on a prorated basis. The participation of series E-1 and E and their double-dipping into the common returns doesn’t impact any other shareholders’ return, because there is no common to double-dip into at this exit.

At a $400M exit when there is no participating series, the series B converts and participates in common. But as we discussed above, participation has the effect of increasing the conversion point for other series, so in this scenario, the optimal decision for the series B is to not convert and keep their preference amount. But this has the overall effect of reducing their returns relative to the first base case scenario, as you can see in the table above.

Once the consideration is above the preference stack then, the series E-1 and E always win, while the other series will always have reduced returns. What’s interesting is when all the series (including the E-1 and the E) have been converted to common in the original base case, then the change in returns is a constant for each series. This is because the series E-1 and E will always get their preference amount upfront, and the remainder gets split between all the other shareholders at their common ownership percent. The net positive returns to the series E-1 and E are logically offset by the net negative returns to the rest of the shareholders. This is why in the table above at $1.8B vs. $2B in exit value the delta in returns is the exact same for each series.

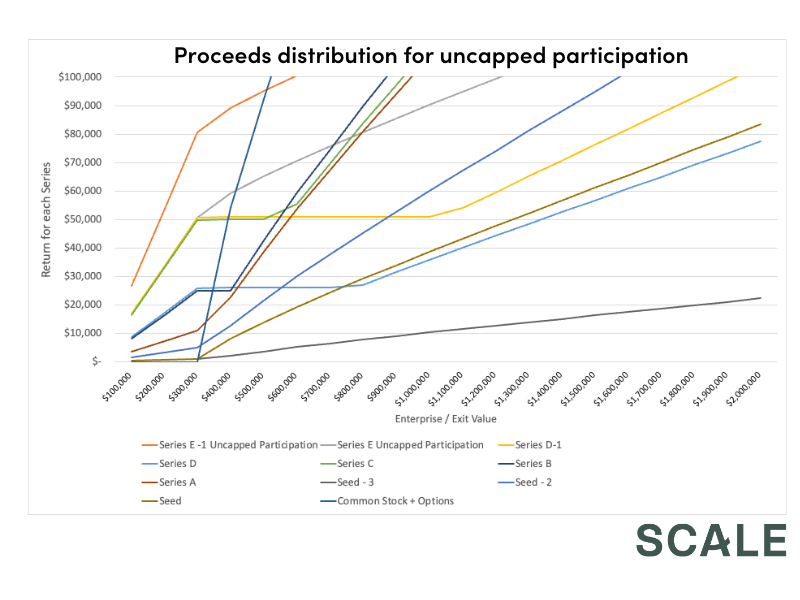

Below is a simple summary chart showing for each series their returns as the Exit Value increases.

This concludes volume 3 of our Liquidation Survival Guide. Here’s one more link to the template. Please remember, the template is a tool, so please work with your advisors as you use it. If you have any comments or questions, or have found any issues with the template, please let me know! This is an effort to help the startup community better understand these analyses and save everyone time. We will periodically update the guide and template if any issues arise.

Looking for more guidance around liquidation? Check out: